Filter by

When Amigo are paying compensation

This blog was written on 15th March 2024, and was based on the available information at the time ...

Read More

Amigo payouts: the road ahead

This blog might be of particular interest to Amigo customers who have their claim upheld through ...

Read More

A Winning Claim (real life example)

We never guarantee success. But, below is a real life example of a successful claim, which we’ve ...

Read More

Evidencing your scam losses – how Allegiant Por...

If we have recently invited you to join Allegiant Portal, it’s because we need to see the banking...

Read More

Unlock your car finance claim

This article is about irresponsible lending of car finance. Let’s set off on our journey…. With A...

Read More

Bad Borrowing (Bad Buying)

Picture the scene: it’s 2016 and a catalogue credit provider sends you an email as their brand ne...

Read More

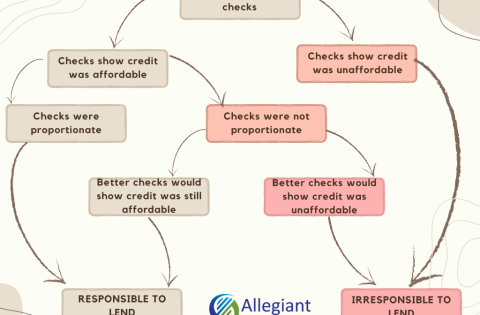

Proportionate Checks?

If you want to better understand irresponsible lending, it’s important to understand what is mean...

Read More

Proving Unaffordability

If you want to have a better Unaffordable Lending claim with Allegiant, we strongly recommend tha...

Read More