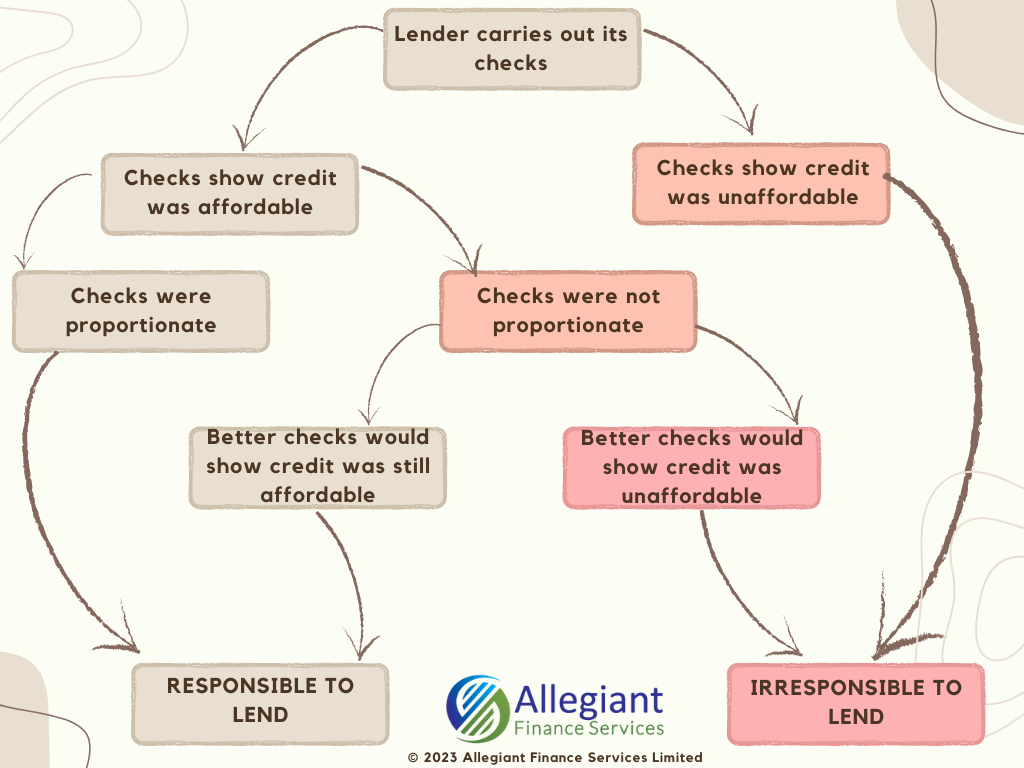

If you want to better understand irresponsible lending, it’s important to understand what is meant by ‘proportionate’ checks.

Lenders need to carry out certain checks before lending, to check that credit is affordable. The checks might be really detailed or not very thorough at all. It is up to the lender what checks they do, although they do need to be proportionate.

For example, a customer borrowing a one-off loan of £100: it is probably not going to be proportionate for the lender to be taking a deep plunge into the customer’s bank statements to check affordability. But if the customer was borrowing £10,000, then really detailed checks would be proportionate. However, it is not just the amount being borrowed which impacts on the level of detail within the checks.

What does this mean for your claim?

Your bank statements might show that you had very little disposable income at the time of the borrowing, and that you could not afford to repay any credit commitments. The two important questions here would be:

(1) Did your lender check your bank statements before it made its lending decision?

If it did, it should not be ignoring information it has to hand, and should have refused to lend to you because you did not have enough disposable income.

But if your lender did not check your bank statements, the second question is:

(2) Would it have been proportionate for your lender to have checked your bank statements?

Lending won’t be responsible if checks were not proportionate, and that better checks would have shown that the credit was not affordable.

Let’s look at real-life examples…

In this case, the lender did not carry out sufficiently detailed checks, so the checks were not proportionate. Had the lender done its job correctly – and carried out better checks – it would have discovered that the lending was unaffordable:

‘Mr W’s indebtedness and apparent inability to manage his money was because he was spending significant amounts of money gambling. And Mr W’s ability to make the repayments to this loan would in large part be dependent on his success as a gambler. Given this, it is apparent to me that Mr W was unlikely to have been able to repay this loan without borrowing further or experiencing financial difficulty.

As this is the case, I think that reasonable and proportionate checks would more likely than not have demonstrated that Mr W was unlikely to have been able to make the repayments to this loan without borrowing further and/or suffering undue difficulty. And, in these circumstances, I find that reasonable and proportionate checks would more likely than not have alerted Oplo to the fact that Mr W would not be able to sustainably make the repayments to this loan.

So I’m satisfied that Oplo’s failure to carry out reasonable and proportionate checks in this instance resulted in it failing to act fairly and reasonably towards Mr W.’

https://www.financial-ombudsman.org.uk/decision/DRN-4222194.pdf

In this next case, the lender should have carried out better checks. However, the ombudsman did not say the lending was irresponsible; this was because there was no evidence that more proportionate and detailed checks would have revealed the credit to be unaffordable:

‘I think the information 118 118 Money gathered should have prompted it to find out more about Mr T’s financial situation at that time. But that’s not a reason for me to uphold the complaint if I can’t also point to information that 118 118 Money should’ve found out showing that the loan wasn’t affordable for Mr T.’

‘All in all, as I’ve not been able to see what better checks would have shown 118 118 Money, I am unable to say that Mr T was given a loan that was unaffordable for him or irresponsibly lent.’

https://www.financial-ombudsman.org.uk/decision/DRN-3550089.pdf

In this last case, it did not much matter what checks were proportionate – as the lender should not have lent the money anyway – based on what it did see at the time:

‘Barclays would have been able to see from Mr P’s bank statement that Mr P was unlikely to be able to sustainably repay further lending because of his deteriorating income and his reliance on third party funds.’

https://www.financial-ombudsman.org.uk/decision/DRN-4230370.pdf

You might have a claim like the above, or it might be completely different. If Allegiant are handling a claim for you, we will provide you with our advice.