This blog was written on 15th March 2024, and was based on the available information at the time of publication.

Not everyone will be compensated

Before we talk about the timetable for compensation payouts, an important reminder that not every customer will receive a compensation payout:

Types of Amigo Scheme compensation

There are 2 main types of compensation through the Amigo Scheme:

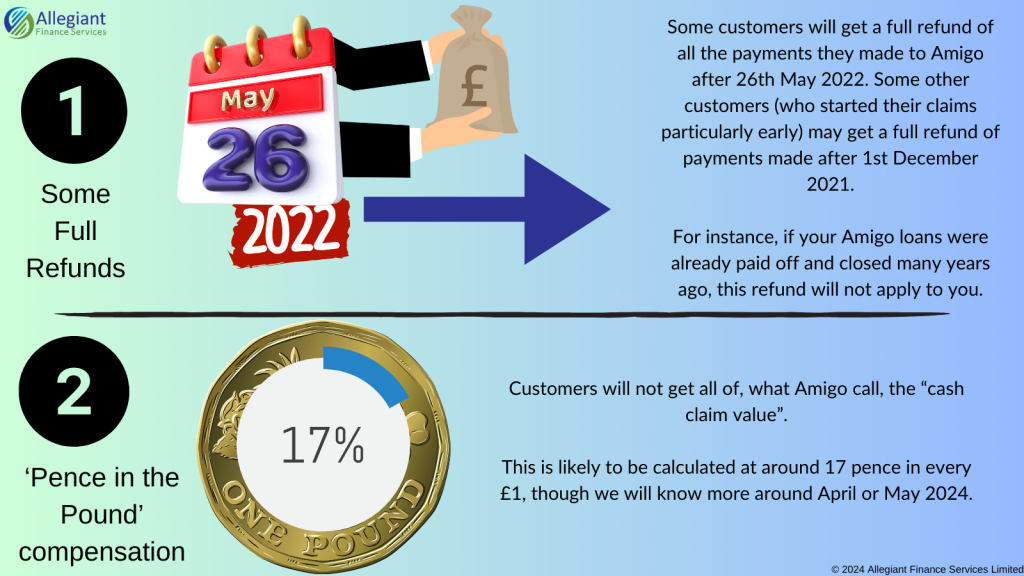

(1) Some Full Refunds

Here’s when this refund applies:

- The borrower has made enough repayments to Amigo to cover at least the borrowed amount (excluding interest); and

- If the customer initiated their claim for unaffordable lending against Amigo on or before 1st December 2021 – they will receive a full refund of the payments made from 1st December 2021 onwards; or

- If the customer initiated their claim for unaffordable lending against Amigo between 1st December 2021 and 26th May 2022 – they will receive a full refund of the payments made from the date of their first claim; or

- Payments made after 26th May 2022 (the ‘Scheme Effective Date’) will be refunded to the customer if their claim was initiated after that date.

For instance, if you haven’t made any payments to Amigo in recent years (maybe because your loans with them were already paid off several years ago), this ‘full’ refund doesn’t apply to you.

(2) ‘Pence in the Pound’ compensation

This compensation is for interest you have paid on mis-sold Amigo loans. Amigo call the total amount the “cash claim value” – although you will not receive the full amount of your “cash claim value”.

Amigo implemented the Scheme of Arrangement because it doesn’t have sufficient funds to fully compensate all customers. While the final calculation is still unknown, Amigo estimates compensation based on 17p for every £1. Therefore, £1,000 of loan interest would result in a payout of £170.

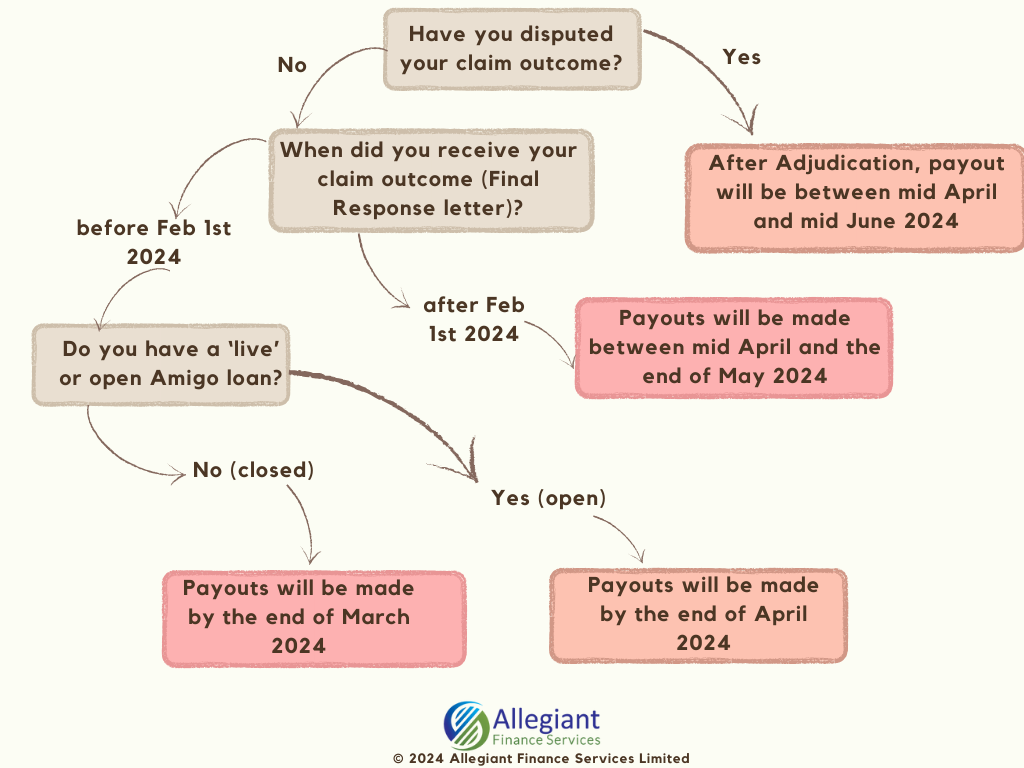

Payouts in 2024

For the customers eligible for the full refunds of their payments (mainly after 26th May 2022), let us take a look at when Amigo have said these customers will be receiving their refunds. In summary, it depends on the date of the ‘Final Response’ letter you received from Amigo. This is the letter which sets out the outcome of your claim. The timetable for expected payment also depends on if you are challenging the outcome of your claim with a Scheme Adjudicator:

It is worth being prepared for these dates to be pushed back further, as Amigo have already done so several times.

Amigo are planning to provide more information about the ‘pence in the pound’ amount in April or May 2024. It could end up being 17p in every £1 of cash claim value – or it might be slightly higher – we just don’t know at this stage.

What we do know is that Amigo plans to make these payouts in two stages. So, for example, the first stage might be payouts based on 10p in every £1 – and it is possible that some customers may start to receive these from May 2024 onwards. There would then be a second payout of around 7p in every £1 – towards the end of 2024.

The exact timing of when customers will receive this payout will vary. And it would be logical to assume that – like the full refunds – it might depend on whether you are challenging your claim outcome by escalating it to a Scheme Adjudicator.

Read more about Amigo’s Scheme at Amigo Loans Scheme | Scheme of Arrangement (amigoscheme.co.uk)