This blog might be of particular interest to Amigo customers who have their claim upheld through the Scheme of Arrangement, and are waiting for their compensation payout.

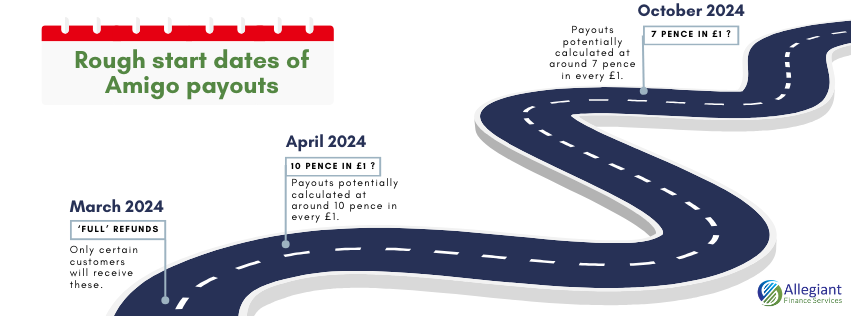

We understand that customers have waited an awfully long time for their compensation from Amigo and are keen to know when payouts will be made. Below is what we understand about the road ahead. Allegiant cannot change the timetable for payouts, as this has been set by Amigo, and it may be subject to change at short notice.

This blog was written on 27th February 2024, and was based on the available information at the time of publication.

Please also bear in mind that these dates are roughly when payments are expected to start being made to customers. Some customers’ claim outcomes are still going through appeal, so inevitably their payouts will come later than some other customers.

We are aware that Amigo began making payments to a handful of customers in late February 2024. But they’re not expected to be in full swing – and making payments to larger numbers of customers – until March 2024.

March 2024

‘FULL’ REFUNDS

Please note that this March 2024 payout applies only to certain customers and specific payments. Here’s when it applies:

- The borrower has made enough repayments to Amigo to cover at least the borrowed amount (excluding interest); and

- If the customer initiated their claim for unaffordable lending against Amigo on or before 1st December 2021 – they will receive a full refund of the payments made from 1st December 2021 onwards; or

- If the customer initiated their claim for unaffordable lending against Amigo between 1st December 2021 and 26th May 2022 – they will receive a full refund of the payments made from the date of their first claim; or

- Payments made after 26th May 2022 (the ‘Scheme Effective Date’) will be refunded to the customer if their claim was initiated after that date.

For instance, if you haven’t made any payments to Amigo in recent years (maybe because your loans with them were already paid off several years ago), this ‘full’ refund, starting in March 2024, doesn’t apply to you.

April 2024

10 PENCE IN £1

If your claim for unaffordable lending has been upheld, then some of the loan interest will be refunded along with compensatory interest at a rate of 8%. However, this is contingent on enough repayments being made to Amigo to cover the original borrowed amount. For example, if you borrowed £2,000, you must have repaid that amount through monthly instalments before qualifying for any compensation.

Even if you have repaid enough to cover the borrowed amount, you won’t receive the full interest back. This is due to Amigo’s financial limitations and its need to implement the Court-approved Scheme of Arrangement.

Amigo implemented the Scheme of Arrangement because it doesn’t have sufficient funds to fully compensate all customers. While the final calculation is still unknown, Amigo estimates compensation based on 17p for every £1. Therefore, £1,000 of loan interest would result in a payout of £170.

Although the exact calculation (around 17p for every £1) remains uncertain, Amigo might be confident that initial payments of 10p for every £1 can be made to customers around April 2024.

October 2024

7 PENCE IN £1

The final payment amount is particularly uncertain and depends on how much money Amigo has left to compensate customers as it winds down its operations. The current estimate suggests a payment of 7p for every £1, resulting in an overall payout of 17p for every £1 (when combined with the April 2024 payout).

It’s possible that the final payment could be more than 7p, potentially reaching up to 8p or an amount in between. However, it’s too early to make any definitive statements.

Although it requires more patience as the final payout will be closer to the end of 2024, this split does not reduce the total compensation you are entitled to.

No payout at all…

It’s important to note that not everyone will receive the above compensation payouts from Amigo:

- If repayments haven’t covered the borrowed amount from Amigo, then no payout will be issued to the borrower. For example, if you borrowed £3,000 (excluding interest) but only paid back £1,000, you won’t receive any compensation.

- Compensation is typically based on the payments made by you and not someone else. Remember that Amigo loans can be repaid by both borrowers and guarantors.

- Not all loans were deemed unaffordable or irresponsibly granted according to the Scheme of Arrangement assessment criteria.