Here at Allegiant we’ve been claiming against high cost lenders since 2013 and have a long track record in claiming redress for our customers.

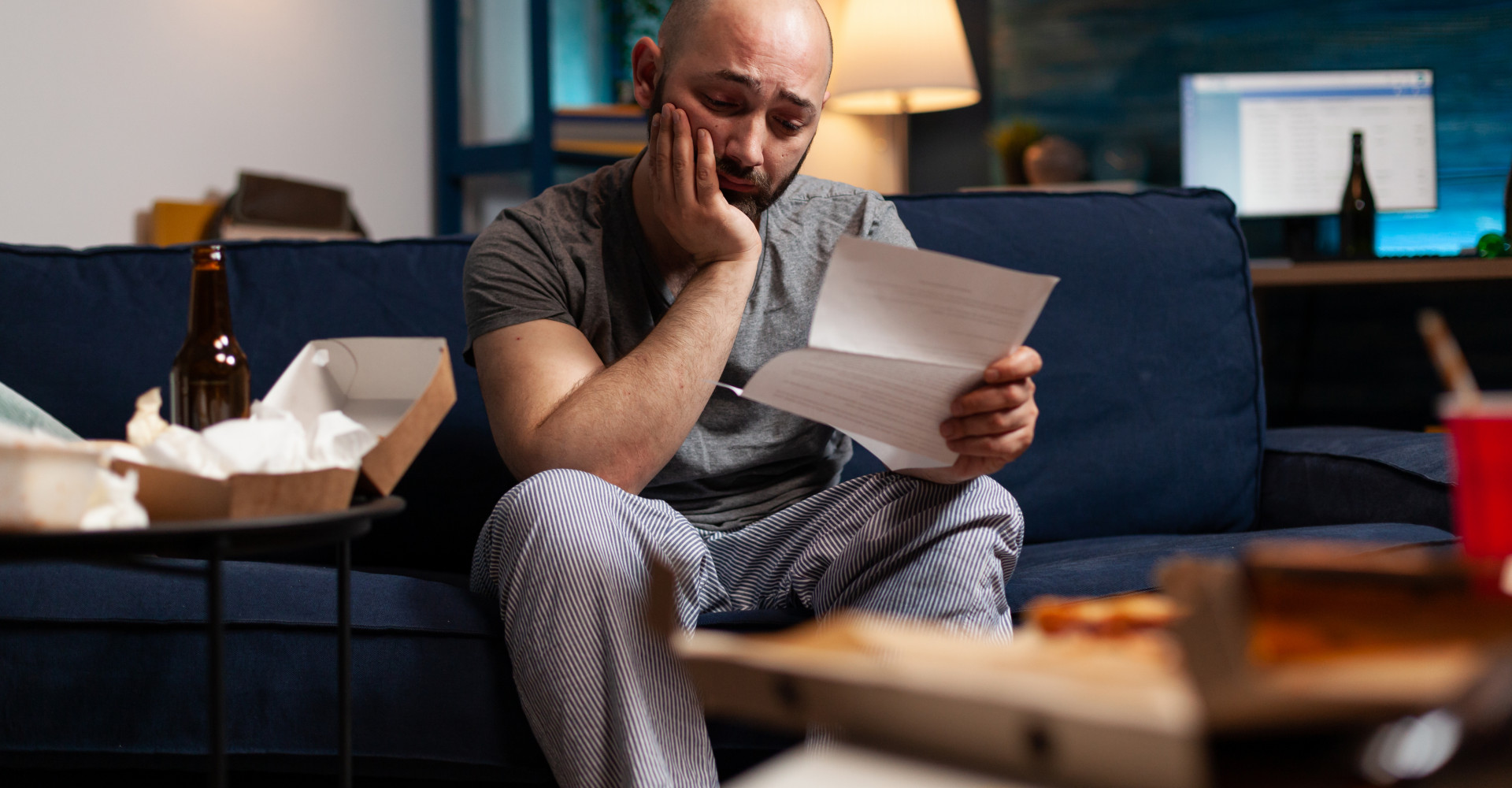

High cost loans can cause misery when the lender does not undertake proper affordability checks either at the outset of the lending relationship, or when re-lending. This has left many people struggling to survive after making loan payments. Sound familiar?

The FCA states: “A vulnerable customer is someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.”

Many of our customers explain to us they were in a financially vulnerable position at the time they obtained finance from their lender. We often hear that the lending of unaffordable finance resulted in customers falling into a spiral of problem debt or made an existing debt problem worse. Regularly, our customers tell us the stress and pressure due to money and debts has impacted their mental health.

National debt advice charity, StepChange, reported in their Statistics Yearbook 2020 that 50% of around 500,000 clients who contacted them for new debt advice sessions between January and December 2020 advised they were in vulnerable situations in addition to their debt situation. Vulnerable situations included physical or mental health conditions, learning disability, sight or hearing difficulties or other situations that can make dealing with problem debt particularly difficult.

Our advisers are expert in financial mis-selling claims and our aim is to help put things right. Dealing with a claim alone can seem complicated or overwhelming. We are here to act as your representative to help make the process of making a claim as simple and stress-free as possible. We can’t guarantee the outcome of your claim from the outset, but our role as your representative is to use our experience to help you secure the best possible outcome. Every claim is assessed on individual circumstances. If your claim is successful, the lender will offer to repay the interest you paid on the upheld loans plus a statutory 8% interest on this amount.

We’re here to help with your claim. We want you to know that if you are experiencing other difficulties such as money, debt or mental health, you are not alone and there is free help and support available.

The organisations listed below are very experienced in helping, assisting, and dealing with people who are having difficulties.

There are many websites out there claiming that they can give you free, independent advice and guidance. You should always check and verify the qualifications, licenses, and regulatory compliance of any individual or organisation you may approach for advice. Especially regarding serious matters such as legal or financial issues. If you are in any doubt at all, contact the organisations below.

Money and debt:

| Organisation | Service | Location | Phone number | Website address |

| MoneyHelper | Government-backed financial guidance from the Money Advice Service, the Pensions Advisory Service and Pension Wise. Their services include: benefits, everyday money including banking and budgeting, family and care, homes, money troubles, retirement and pensions, savings and work. | National – Find your nearest local debt advice via: https://www.moneyhelper.org.uk/en/money-troubles/dealing-with-debt/use-our-debt-advice-locator | https://www.moneyhelper.org.uk/en | |

| StepChange | Debt Advice | National | Freephone0800 138 1111 Free to call from major mobile networks | http://www.stepchange.org |

| Citizens Advice | Citizen’s Advice offers help and advice in many areas including: benefits, work, debt and money, consumer, housing, family, law and courts, immigration, health and more. | Find your local Citizen’s Advice centre on their website. | www.citizensadvice.org.uk | |

| National Debt line | Debt Advice | National | Freephone 0808 808 4000 | https://www.nationaldebtline.org/ |

| Money and Pensions Service | Money and Pensions | National | 0800 138 7777 | https://moneyandpensionsservice.org.uk |

| Business Debt line (For business) | Debt advice for business and self employed | National | Freephone 0800 197 6026 Webchat – see website | https://www.businessdebtline.org/ |

| National Gambling helpline | Help with gambling | National | Freephone 0808 802 0133 Webchat – see website | https://www.gamcare.org.uk/get-support/talk-to-us-now/ |

| Gamblers Anonymous | Help with gambling | National | 0330 094 0322 | https://www.gamblersanonymous.org.uk/ |

Support for Mental Health

We understand that there is a link between money and mental health. We support Mind, Mental Health Charity. Mind provides support and advice to empower anyone experiencing a mental health problem, and campaigns to improve services, raise awareness and promote understanding. For more information about Mind or for support, please visit Mind’s website:

If you need non-urgent information about mental health support and services that may be available to you, please call Mind Infoline on 0300 123 3393 or email info@mind.org.uk.

If you feel unable to keep yourself safe, it’s a mental health emergency, call 999. If you feel you can keep yourself safe for a short while, call 111 or contact your local GP requesting an urgent appointment.

Whatever you’re going through, there are people you can talk to any time. You can:

- call Samaritans on 116 123 (UK-wide)

- text SHOUT to 85258 (UK-wide)

- call C.A.L.L. on 0800 132 737 (Wales only)

Our contact details

The Allegiant team are here to help you with your claim. We’re here throughout every stage of the claim from start to finish. Our team may be contacted by telephone or email.

- Helpline telephone number: 0345 544 1563 (calls charged at local rate)

- Office Hours: Monday to Friday 8:30 am – 5:00 pm excluding bank holidays.

- Email: helpdesk@allegiant-finance.co.uk

- For invoice or payment queries please ask to speak to our Credit Control team, or call them directly: 01925 912 040 (calls charged at local rate)

- Postal address: Allegiant Finance Services, 400 Chadwick House, Warrington Road, Birchwood Park, Warrington, WA3 6AE.

- Website: https://allegiant.co.uk/