Wonga, Wageday Advance, Instant Cash Loans, Quick Quid, 247 Moneybox, Piggybank, Peachy, Uncle Buck, Myjar, and many more… All are ‘Payday’ lenders who are no longer in business. Aside from meaning that you can no longer borrow money from these companies, it also means that you cannot make an Unaffordable Lending complaint against any of these companies either. There are still some Payday lenders around today – but not very many – so we are going to focus on some of the above lenders.

Unfortunately, for these Payday loan companies, there is no protection for when they go bust – and they are not covered by the Financial Services Compensation Scheme. In summary, the time to get any money from those companies has gone. But does that mean it is the end of their importance?…

Before we look forward to Unaffordable Lending complaints you can make now, let us take a little look back in time. According to a BBC News article, Wonga had a million customers at its height, in 2013. That is a lot of customers taking Payday loans – quite a specialist financial product which was open to mis-use and mis-selling. We now know that customers did not simply take a one-off injection of cash to tide them over until their wages came in later in the month.

Instead, for many people the expensive nature of the borrowing was offset against the ease at which Payday loans could be obtained. Payday loans allowed some people to move their money around: take out a Payday loan to clear an overdraft, use an overdraft to pay a credit card bill, use the credit card for everyday spending, without clearing the balance. This is what some people would call ‘robbing Peter to pay Paul’ – with money (and debt) just being moved around without any inroads really being made into a person’s current liabilities. That is not sustainable.

It is within this ‘juggling’ of different commitments that we can see the relevance of historic Payday loans. Let’s take an example: you make an Unaffordable Lending complaint against your Catalogue Credit lender (there are still plenty of those types of companies still in operation, so complaints can still be made against them). It might be argued that you should not have been given increased credit limits on your Catalogue Credit account because you were already mis-managing your finances by taking out multiple Payday loans. In these circumstances it would undoubtedly help your claim if there was evidence of those Payday loans. It would not matter if those Payday lenders were no longer in business (remember: the complaint is not against them) but it does of course mean that you would need to have the evidence yourself.

In this Final Decision about Catalogue Credit, an Ombudsman ruled in the customer’s favour and explained:

‘…proportionate checks would have shown Premier Man that Mr T was having difficulty managing his money. Mr T was in a cycle of payday lending and was relying on further lending in order to repay what he already owed. He’d also only made the minimum payment due on his account – and not making any real inroads into what he owed – for most of the year leading up to November 2010

So I think that proportionate checks will have shown Premier Man that Mr T was already struggling to sustainably repay what he owed and that there was a significant risk increasing his credit limit in these circumstances would lead to his indebtedness increasing unsustainably.’ (https://www.financial-ombudsman.org.uk/decision/DRN-3031628.pdf)

In this Final Decision, concerning an Unaffordable Lending complaint about a credit card, the Ombudsman rules in the customer’s favour and explains:

‘NewDay’s data shows he had an active payday loan the month before the credit limit increase. So, as Mr G took out a payday loan shortly before his credit limit was increased on his Debenhams card, this could indicate that the credit limit increase might not be affordable or sustainable for him in the longer term as he did not have enough disposable income to meet his outgoings’ (https://www.financial-ombudsman.org.uk/decision/DRN-2953588.pdf)

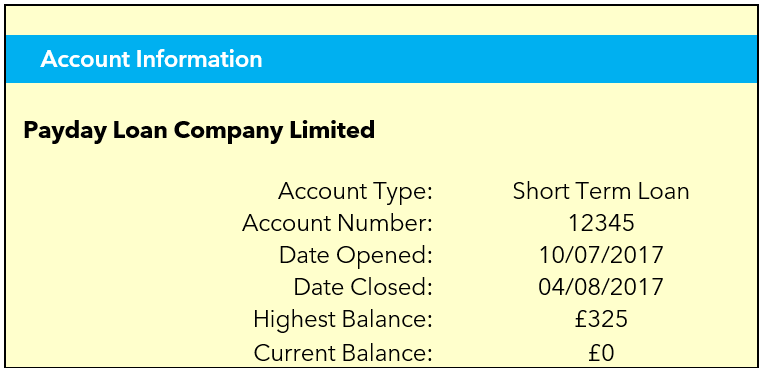

From the above, we can see that it is worth trying to remember if you took out Payday loans alongside another lending product. If you are being represented by Allegiant to make your Unaffordable Lending claim, we might encourage you to give us a copy of your credit report – which might show historic use of Payday loans. Here is an example of how an entry for a Payday loan might look in a credit report:

In the above example, a Payday loan was taken out on 10th July 2017 (from a company which subsequently went bust). This credit file entry might be relevant information if you now decided to make an Unaffordable Lending complaint about credit taken, perhaps late on in July 2017 or in early August 2017. This complaint could be about any sort of product: high interest revolving credit, doorstep loan, etc. Your Unaffordable Lending claim will not be successful solely based on you having one Payday loan outstanding when taking credit with another company – but it could form a part of a bigger picture, of someone juggling multiple credit commitments they cannot afford. It is also worth noting that any lending, you wish to complain about, which was provided before 10th July 2017 will be irrelevant to the above Payday loan credit file entry example. Afterall, responsible lending does not mean that lenders are expected to predict the future and foresee that you were going to take out a Payday loan in the future!

Your historic use of Payday loans might not always appear on your credit report. This could be for several reasons:

- Not all lenders report to all of the credit reference agencies

- If it is more than 6 years since the Payday loan was closed, it will likely not appear on the credit report

- If you previously made a successful Unaffordable Lending complaint against a Payday loan company, like Wonga, they may have removed all of the mis-sold loans already from your credit file.

The three main credit reference agencies in the UK are Experian, Equifax and TransUnion. You can sometimes obtain a credit report for free as a part of a promotional offer.

In conclusion, you cannot make an Unaffordable Lending complaint against Wonga anymore. But if you took out Wonga loans alongside other forms of credit, it may be that those other credit facilities were mis-sold to you, leading to you getting redress. And that is perhaps a part of Wonga’s legacy.