Filter by

- All

- Car Finance Claims (Commission)

- Car Insurance Write Off

- Mortgage Claims

- Pension & Investment

- Press Releases

- Scams & Fraud

- Tax Claims

- Unaffordable Lending

Mis-Sold Car Finance: What You Need to Know

If you’ve recently taken out a car loan and are struggling to meet the repayments, or if you feel...

Read More

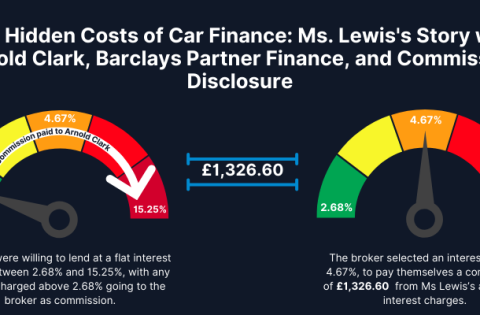

The Story of Ms Lewis, Arnold Clark, Barclays P...

In November 2018, Ms Lewis visited an Arnold Clark showroom in Liverpool to buy a car. Like many ...

Read More

Unravelling Unfairness: Your Guide to Justice

Allegiant has been helping customers make unaffordable lending claims for over 10 years, and we’v...

Read More

Who are Allegiant? 5 ways to find out…

We are Allegiant Finance. We’re a UK-based Claims Management Company. If you have never used our ...

Read More