Widespread mis-selling of loans has become a significant issue in the financial industry, affecting countless consumers and tarnishing the reputation of lenders. The case of Morses Club, a prominent UK-based doorstep lender, serves as a stark example of how irresponsible lending practices can lead to severe consequences for both customers and companies alike.

Widespread Mis-selling

When discussing Morses Club’s mis-selling of loans, it’s important to acknowledge that many customers willingly took out these loans. However, even if a customer agreed to borrow, it was Morses Club’s responsibility to conduct thorough checks to ensure the loan could be repaid sustainably, including interest. When these affordability checks were inadequate, it resulted in irresponsible lending or unaffordable lending, which is considered a form of mis-selling.

A strong indicator of Morses Club’s mis-selling and mistreatment of customers is the high percentage of complaints upheld by the Financial Ombudsman Service (FOS). In the first half of 2021, FOS ruled in favour of customers in 71% of complaints against Morses Club. To put this into perspective, other lenders, banks, and financial firms had an average uphold rate of just 34% in the same period[1]. This suggests that Morses Club treated many of its customers unfairly.

Latest on Morses

Since Morses Club has gone out of business, it is no longer possible to submit a complaint against the company or escalate it to the Financial Ombudsman Service.

Information online suggests that Morses Club has very little funds available to compensate customers for mis-selling and irresponsible lending practices.[2]

Hope for compensation

Although it is no longer possible to seek compensation for mis-sold Morses Club loans, you may still have options to claim against other lenders. This is particularly relevant if:

- You had a history of borrowing from Morses Club due to financial difficulties, and other lenders may have irresponsibly loaned you money despite clear signs of financial hardship.

- You borrowed from other lenders to pay off Morses Club loans, a practice commonly known as “robbing Peter to pay Paul,” which can lead to an ongoing cycle of borrowing and debt.

“I do have some concerns, because apart from £50 a week on groceries, the rest of Mrs D’s weekly outgoings were payments to either Morses, or other credit providers”[3]

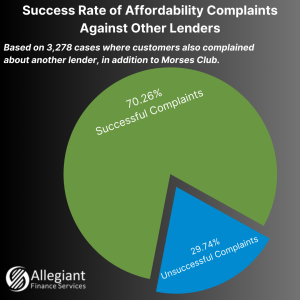

Allegiant has reviewed data from customers who have complained about Morses Club’s affordability practices as well as those who have lodged complaints against other lenders. Our findings show that in approximately 70% of cases, the affordability complaint against the other lender was successful[4]. While no outcome is guaranteed—since each case is judged on its own merits—there is a clear pattern suggesting that Morses Club customers may also be eligible for compensation from other lenders.

Allegiant can assist with these claims, provided the lender is UK-based and still trading. We never charge upfront fees, and you will only need to pay our success fee if and when you receive compensation from the lender.

[1] https://www.financial-ombudsman.org.uk/data-insight/half-yearly-complaints-data/half-yearly-complaints-data-h1-2021

[2] https://find-and-update.company-information.service.gov.uk/company/06793980/filing-history

[3] https://www.financial-ombudsman.org.uk/decision/DRN-3826178.pdf

[4] Based on 3,278 cases where customers filed affordability complaints against another lender in addition to their complaint about unaffordable lending by Morses Club. Of these cases, 70.26% of complaints against the other lenders were upheld. This figure includes some lenders that were solvent at the time of the complaint but may have since become insolvent