Have you ever suspected that your car was undervalued by your insurer after it was declared a write-off?

Allegiant Finance has identified a troubling trend within the car insurance industry where many vehicles are undervalued, potentially entitling owners to significant compensation. Discover how Allegiant champions fair settlements and how you can reclaim what’s rightfully yours, by making a vehicle write off claim with us.

Understanding Car Write-Offs

A car is deemed a ‘write-off’ when it’s considered too damaged to be safe for the road, or when repair costs far exceed the car’s value. Common causes for a car write-off include:

- Accident (your fault or someone else’s)

- Theft of a vehicle

- Vandalism

- Weather Damages (storm, fire or flood)

The core issue arises when insurers retain the damaged car and compensate the owner with an amount that doesn’t reflect the true market value, often leaving the owner out of pocket and unable to purchase a comparable replacement.

| Top 10 most written off cars in 20231 | |||

| Rank | Car Model | Quantity | |

| 1 | Ford Focus | 7,219 | |

| 2 | Ford Fiesta | 6,422 | |

| 3 | Vauxhall Astra | 6,363 | |

| 4 | Volkswagen Golf | 6,123 | |

| 5 | BMW 3 Series | 5,283 | |

| 6 | Nissan Qashqai | 3,423 | |

| 7 | BMW 1 Series | 3,338 | |

| 8 | Volkswagen Polo | 2,852 | |

| 9 | Ford Transit | 2,838 | |

| 10 | Audi A3 | 2,831 | |

Researching for Fairness in Claims

As a Claims Management Company, Allegiant Finance analyses decisions made by the Financial Ombudsman Service to deepen our understanding of claim resolutions. This insight has revealed that many car insurers do not treat customers fairly, which can lead to rightful compensation being withheld.

The Problem with Initial Settlement Offers

Our investigations show that insurers often provide initial settlement offers that are below the vehicle’s market value, with the expectation that they will only increase the offer if the customer objects or files a complaint. This method results in unequal outcomes for customers, depending heavily on their willingness to dispute the initial assessment. We align with regulator concerns that trusting the insurer’s initial valuation can disadvantage customers significantly.

Compensation Findings and Claims Process

“Our review showed firms would sometimes provide initial settlement offers that are below the insured vehicle’s estimated market value or at the lower end of an identified range. Their expectation was that they would then increase the offer if the customer challenged the original one or complained, even if the customer provided no additional information. This approach can lead to systematically different outcomes for different customers, largely based on their propensity to challenge and/or complain. We therefore consider this can be unfair.”2

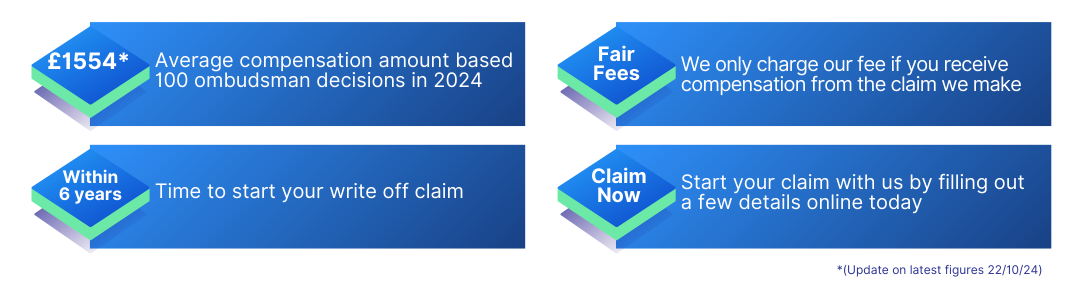

On average, we have discovered that customers are short-changed by approximately £1,5543. If you think your car was undervalued, claiming compensation is straightforward:

- Information Requirement: Minimal information is necessary to begin your claim. It helps if you have details of your written-off car, but don’t worry – you don’t need to provide very much info – we also have our own toolkit at Allegiant, to progress and investigate your claim.

- Fee Structure: We cannot guarantee a successful claim. If your claim is not successful, then we do not charge any fee, so the claim would be for free. We only charge our fee based on any compensation pay out resulting from the claim we made for you. This means we do not charge a fee for the pay out your insurer made to you before Allegiant’s involvement.

- Time Constraints: There are time limit rules for making a claim for compensation against your insurer. The Financial Ombudsman Service will not usually consider a complaint if the car write-off was more than 6 years before raising the complaint. Once your claim starts, you can expect to wait a few months to get a claim outcome, though some claims can take even longer if the insurer decides to defend its actions.

Allegiant’s Track Record

For over a decade, Allegiant has successfully fought against unfair practices in the financial sector, recovering over £67 million in claims for our clients. From tackling Payday Loan disputes, Unaffordable Car Finance claims, Scam and Fraud Reimbursement claims to mis-sold Pensions, our experience ensures that our clients receive the justice they deserve.

Don’t settle for less. If your car was written off and you feel the insurance pay out was insufficient.

Start your compensation claim with Allegiant Finance today.

1 https://www.topgear.com/car-news/list/these-were-10-most-written-cars-britain-2023

2https://www.fca.org.uk/publications/multi-firm-reviews/findings-multi-firm-review-insurers-valuation-vehicles

3 Based on 100 Ombudsman decisions between 1st January and 1st September 2024