If we have recently invited you to join Allegiant Portal, it’s because we need to see the banking transactions where you lost money to the scammer.

In short, claims need evidence. Allegiant Portal uses ‘open banking’ technology to allow our staff read-only access to your bank statements. This can only happen with your consent.

Here is an example of an ombudsman’s decision, where the ombudsman needed sight of the banking transactions in order to decide that the customer (Miss D) should be compensated for her losses from the scam:

– I’ve considered Miss D’s account activity in the year leading up to the disputed transactions to establish whether the transactions ought to have appeared so unusual or uncharacteristic that Barclays should have paused them pending further enquiries.’

– ‘Miss D made three large-value transactions on 14 April – all to cryptocurrency exchanges. While previous account activity does show individual large-value transactions – up to £10,000 – given the increased frequency of transactions on 14 April, I think Barclays ought to have been concerned that there was a possibility that something wasn’t right. Specifically, the third transaction that day – £5,228.19 – ought to have triggered the bank’s fraud detection systems.’

https://www.financial-ombudsman.org.uk/decision/DRN-4184003.pdf

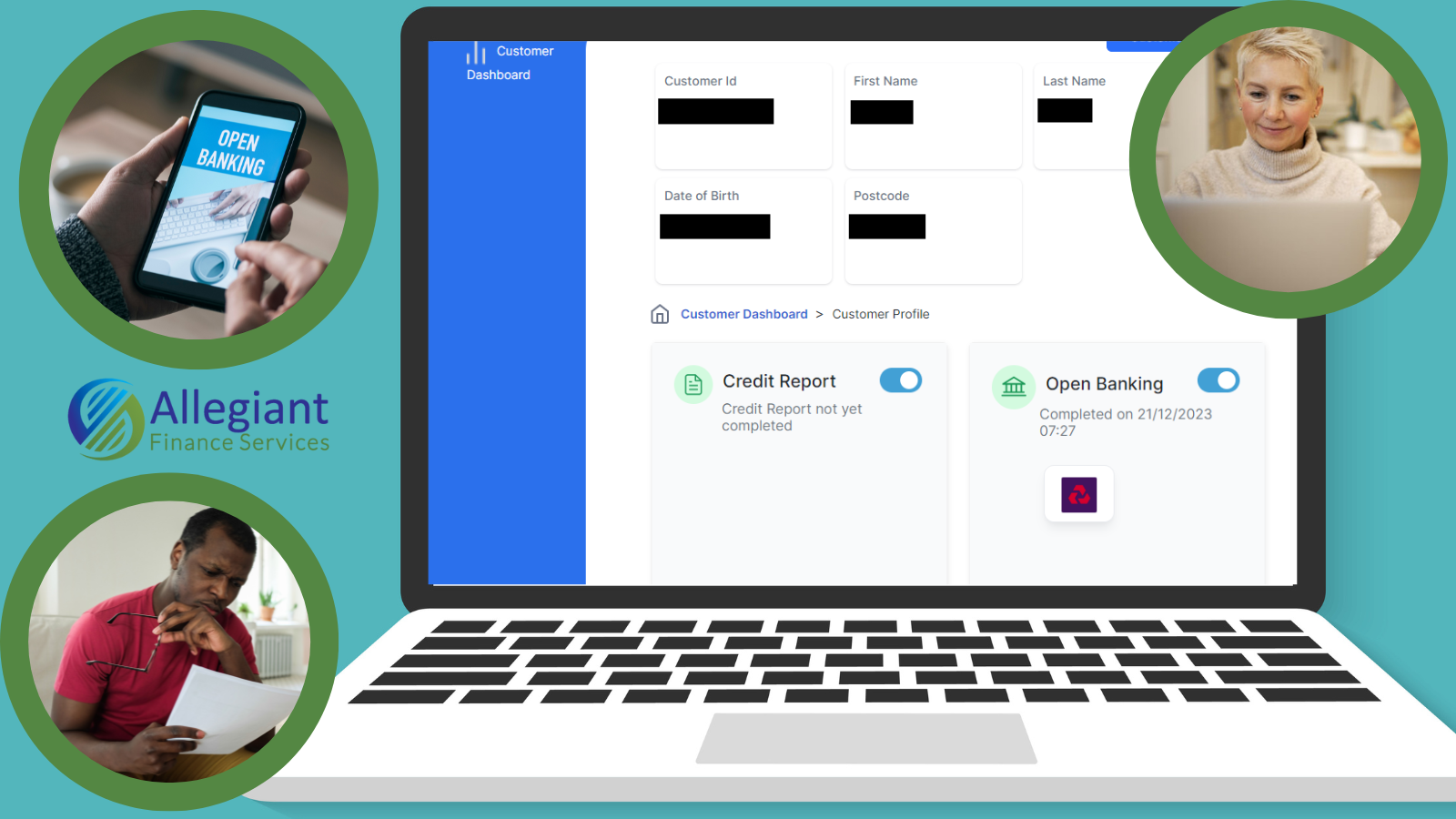

You may have heard of the company ‘Yapily’? Well, Allegiant has teamed up with Yapily in order to provide our open banking solution to our customers. This saves on the effort of customers having to request or download statements from their bank, and then having to manually search for the scam-related transactions themselves.

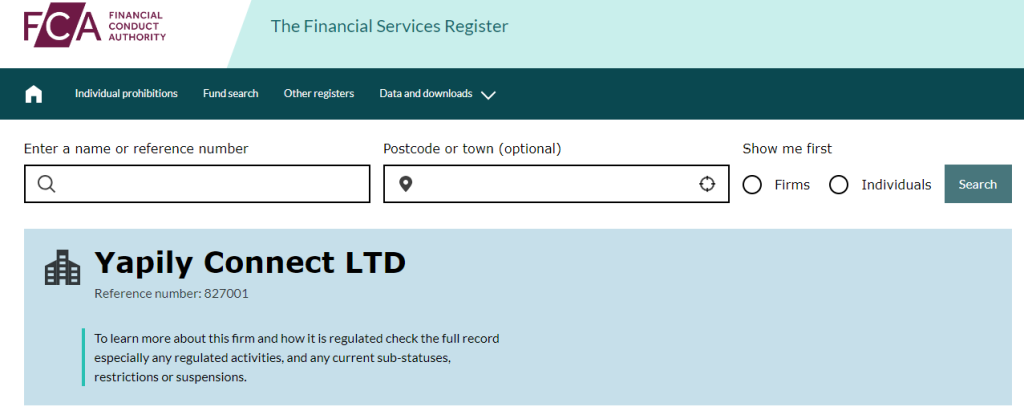

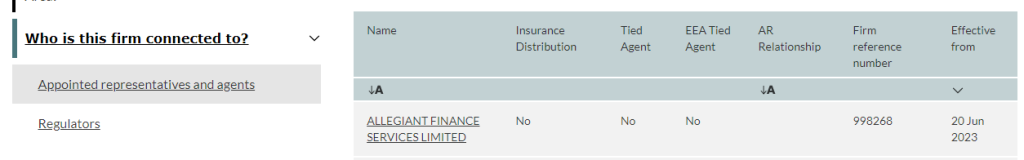

The Financial Conduct Authority (FCA) regulates claims management companies like Allegiant. And you can see the link between Allegiant and Yapily on the FCA’s Financial Services Register: https://register.fca.org.uk/s/firm?id=0010X00004J9MH9QAN

The important thing to remember is that we only have read-only access to your account information. We cannot – and would not – make any changes whatsoever to your bank account.

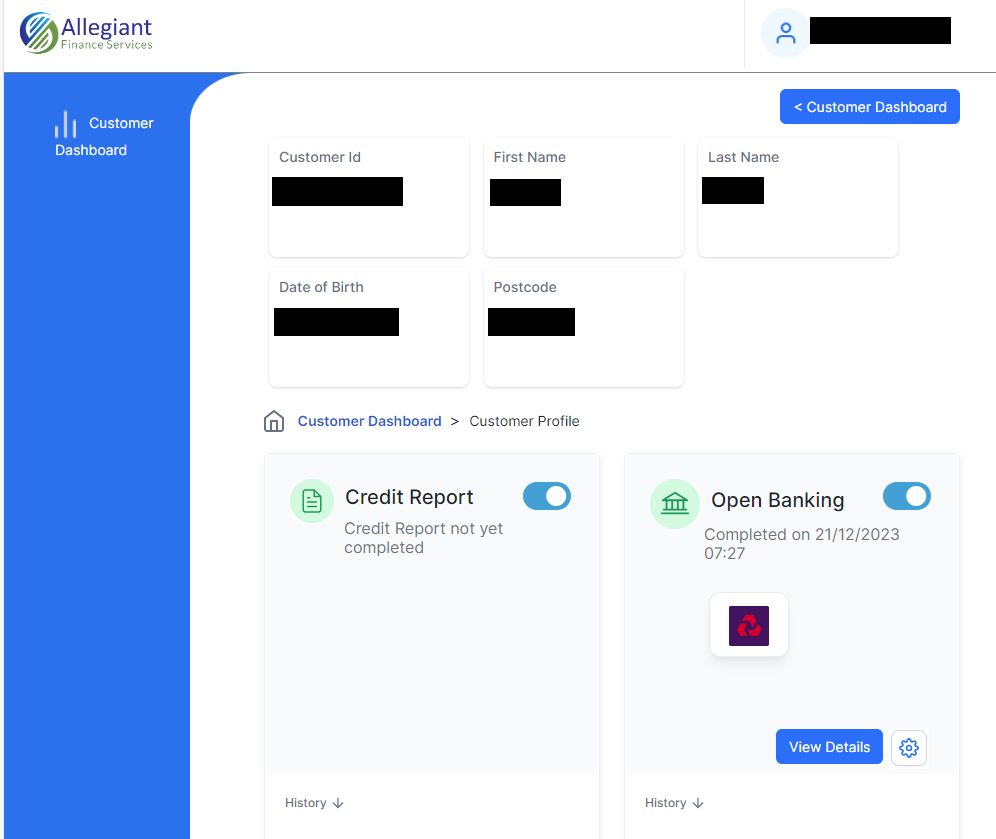

Once you’ve accepted our invite, our staff will have access to your customer dashboard:

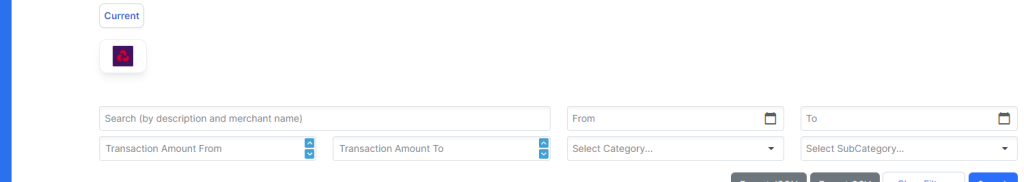

Remember that we’re only looking at your banking transactions to help you with your scam reimbursement claim. We are able to quickly and easily search and filter your bank statements to find the relevant information for your scam reimbursement claim:

If you have any questions, or are unsure of anything, let us know and we’d be happy to help.