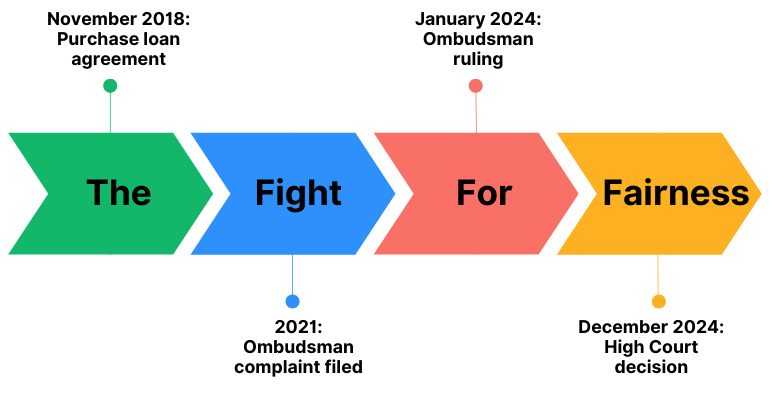

In November 2018, Ms Lewis visited an Arnold Clark showroom in Liverpool to buy a car. Like many buyers, she needed a loan to make the purchase. Arnold Clark introduced her to Barclays Partner Finance (trading as Clydesdale Financial Services), and Ms Lewis entered into a finance agreement to borrow the money she needed for the car.

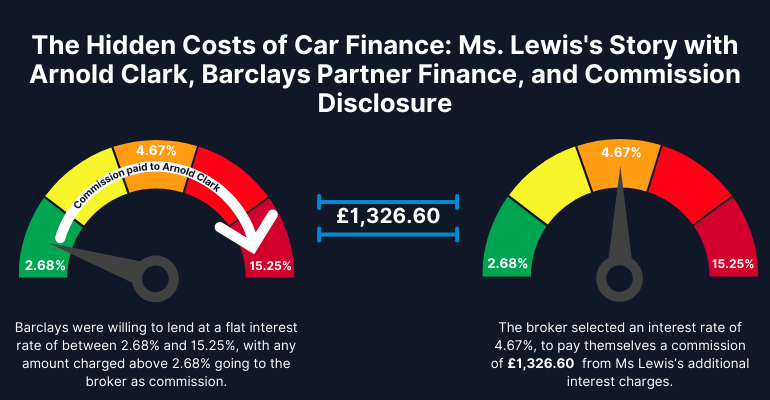

This finance agreement wasn’t as simple as it seemed. Behind the scenes, Arnold Clark, acting as a broker, set the interest rate on Ms Lewis’s loan. The interest rate wasn’t fixed by Barclays—it was determined by Arnold Clark within a range Barclays allowed. The higher the interest rate Arnold Clark chose, the more commission they earned from Barclays. In Ms Lewis’s case, Arnold Clark selected an interest rate of 4.67% (equivalent to 8.9% APR), earning themselves £1,326.60 in commission.

What’s the Problem with Commission?

The issue here was how this commission worked. Barclays gave Arnold Clark a corridor of possible interest rates, ranging from 2.68% to 15.25%. This setup incentivised Arnold Clark to charge Ms Lewis a higher interest rate so they could maximise their commission. Essentially, the higher Ms Lewis’s loan payments, the more Arnold Clark profited.

But Ms Lewis wasn’t told about this commission arrangement. She didn’t know that Arnold Clark had control over the interest rate or that the rate they chose directly affected the payments she would make for years to come. The Financial Conduct Authority (FCA) later identified this type of commission model as problematic and banned it in 2021.

The Ombudsman Steps In

In 2021, Ms Lewis filed a complaint with the Financial Ombudsman Service (FOS). She argued that she had been treated unfairly because she wasn’t informed about the commission arrangement and that this resulted in her paying more than she should have.

The Ombudsman agreed. In a decision issued in January 2024, they ruled that:

- The commission model created a conflict of interest, incentivising Arnold Clark to prioritise their profit over Ms Lewis’s financial well-being.

- Barclays failed to disclose how this commission worked, leaving Ms Lewis at an unfair disadvantage.

- This created an “unfair relationship” under the Consumer Credit Act, breaching principles of fair treatment and transparency.

The Ombudsman ordered Barclays to compensate Ms Lewis for the extra payments she made due to the higher interest rate and reduce the remaining payments on her loan.

Barclays Fight Back Fails

Instead of accepting the Ombudsman’s legally binding decision, Barclays took a slightly unusual step—they challenged it in court through a process called a ‘judicial review’. This wasn’t about whether the commission arrangement was fair, but whether the Ombudsman had made an error in law or acted irrationally.

In December 2024, the High Court sided with the Ombudsman, dismissing Barclays’ claims. The court confirmed that the Ombudsman’s decision was lawful and rational.

Why This Matters

This case highlights a critical issue in car finance deals: the lack of transparency around broker commissions. Many consumers, like Ms Lewis, were unaware that the interest rate they pay might be influenced by the broker’s profit motives. The FCA’s 2021 ban on such discretionary commission models aims to prevent similar harm in the future.

For Ms Lewis, the decision means fairer treatment and financial redress. For Barclays, it’s a reminder of the importance of transparency and accountability in financial dealings.

If you’re taking out a loan for a car, it’s worth asking questions about how the interest rate is set and whether your broker stands to earn commission from your deal. Knowledge is power, and knowing what to look out for can save you money in the long run.

https://www.financial-ombudsman.org.uk/decision/DRN-4326581.pdf

https://caselaw.nationalarchives.gov.uk/ewhc/admin/2024/3237