If you’ve had a car written-off through accident or theft within the last 6 years, ever stopped to think if your insurer gave you the correct claim settlement?

Your insurer is supposed to fairly value your vehicle based on what its market value would have been shortly before it was damaged-beyond-repair in an accident, or stolen. Whilst there are insurers who play fair, and make the correct settlement payout promptly, not all insurers are doing the right thing, all of the time.

If your car had a pre-accident value of £10,000, would you accept an initial settlement from your insurer which valued your vehicle at only £7,944? Say you go back and challenge that valuation, so your insurer gives you a second settlement offer based on a valuation of £8,805… Based on our review of just over a dozen cases from 2024, this scenario – with roughly these amounts – is not at all unusual[1]. It would be understandable if you left the valuation of your vehicle to the experts, not knowing that your insurer was short-changing you.

The regulator of the insurance companies (The Financial Conduct Authority) has expressed its concern about insurers making initial lowball offers. This is where the insurer deliberately undervalues the vehicle in the hope that the customer won’t go back to them to challenge the valuation and request a higher settlement:

“A firm’s first offer for the settlement price of a written-off vehicle should be its best estimate of its market value. Our review showed firms would sometimes provide initial settlement offers that are below the insured vehicle’s estimated market value or at the lower end of an identified range. Their expectation was that they would then increase the offer if the customer challenged the original one or complained, even if the customer provided no additional information. This approach can lead to systematically different outcomes for different customers, largely based on their propensity to challenge and/or complain. We therefore consider this can be unfair.”[2]

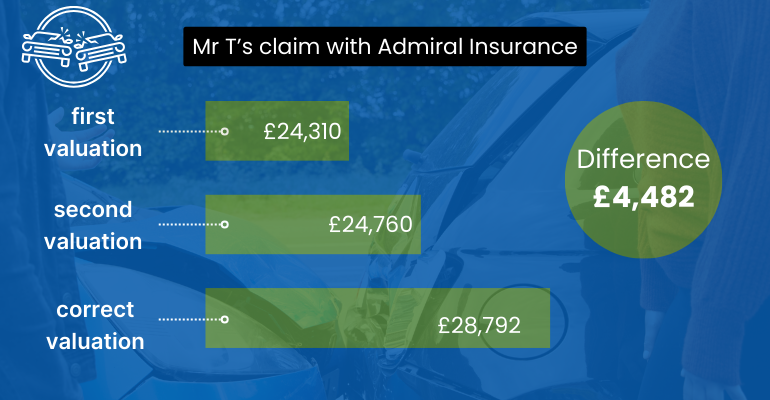

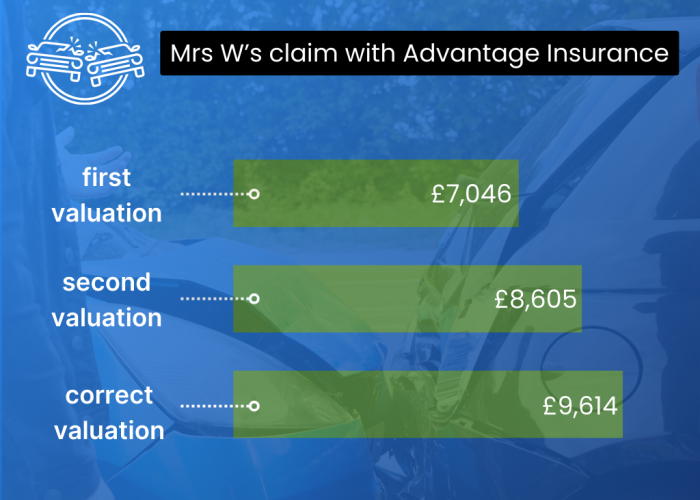

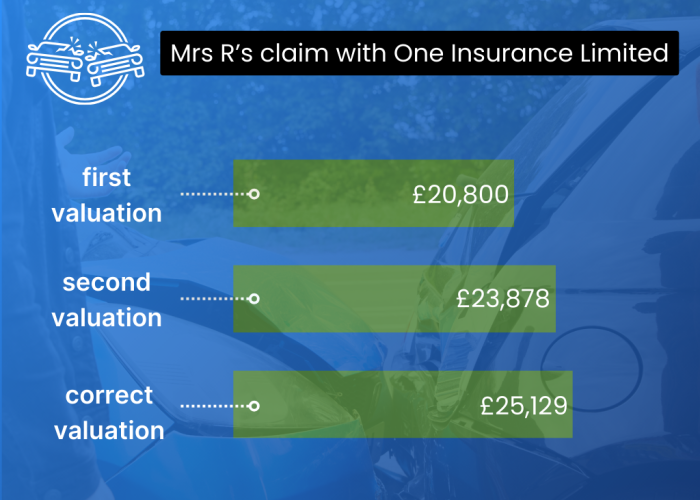

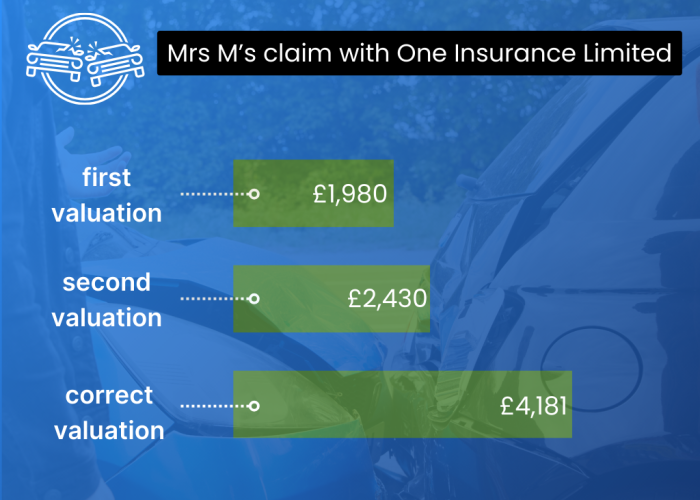

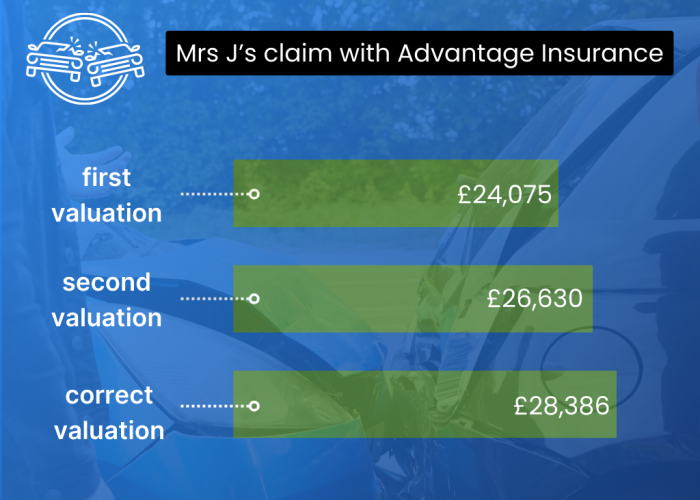

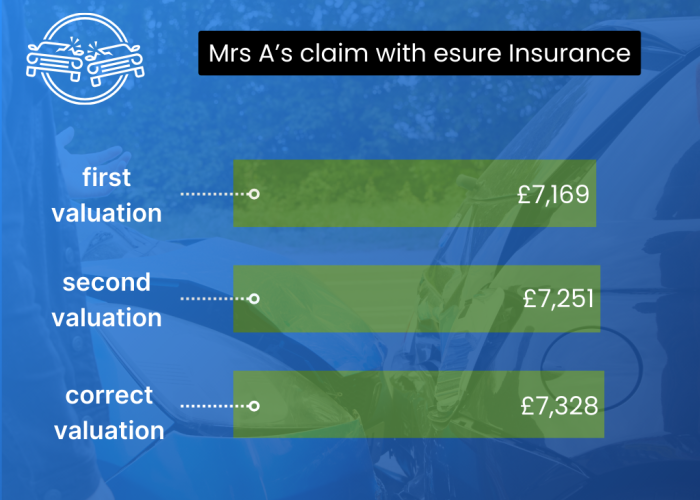

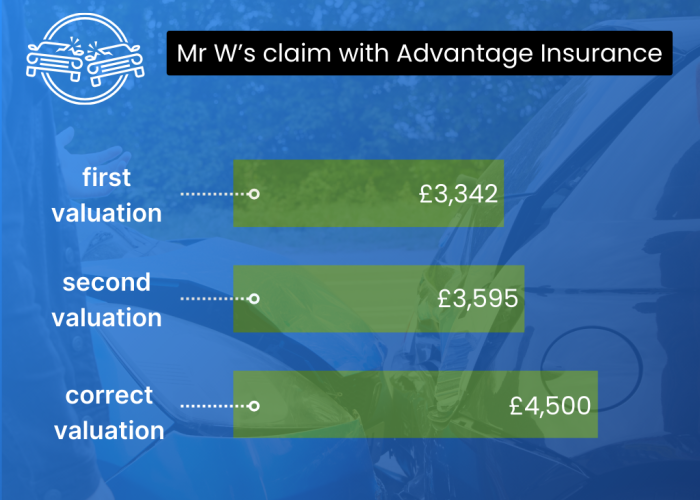

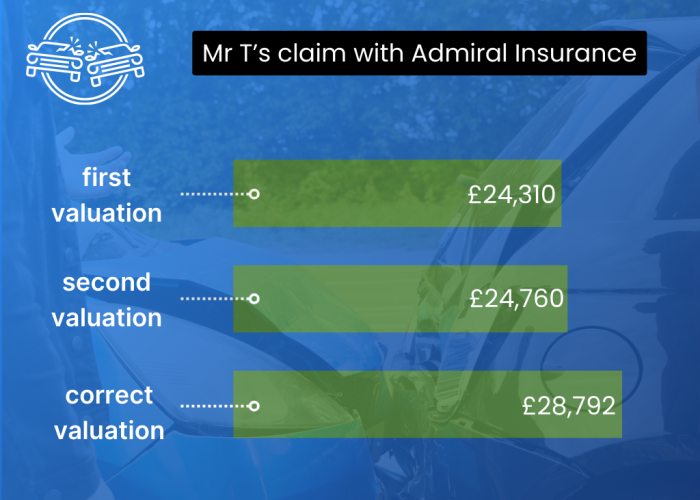

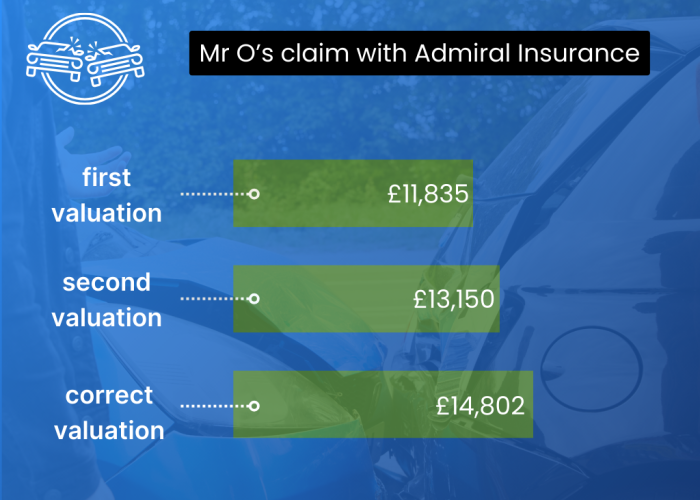

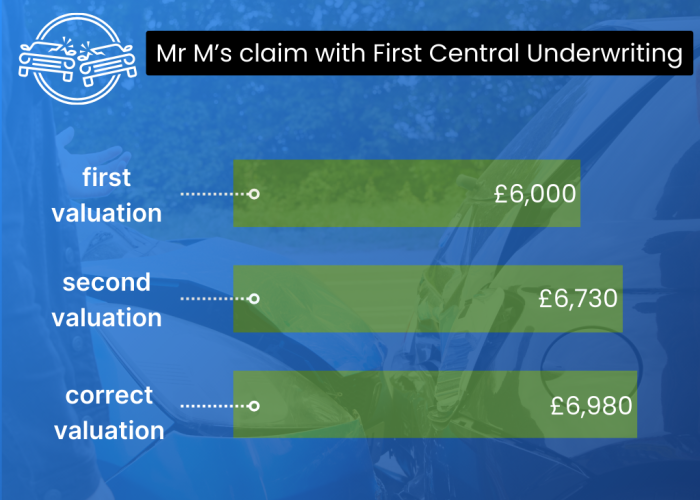

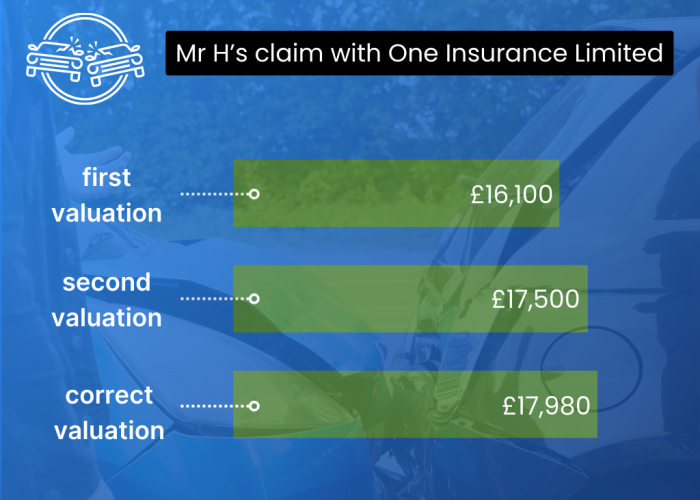

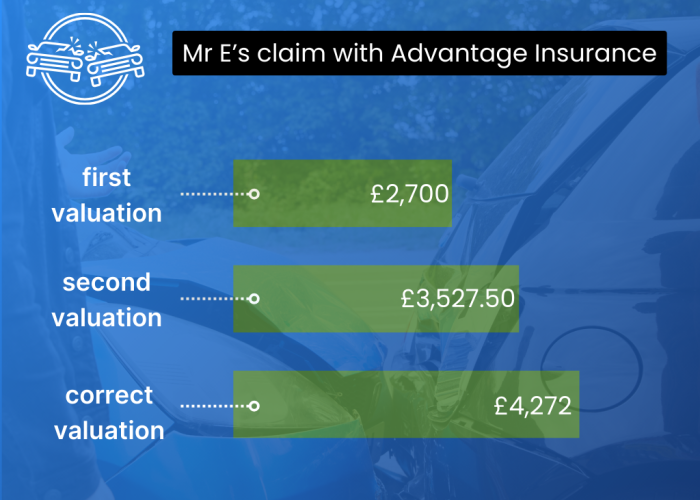

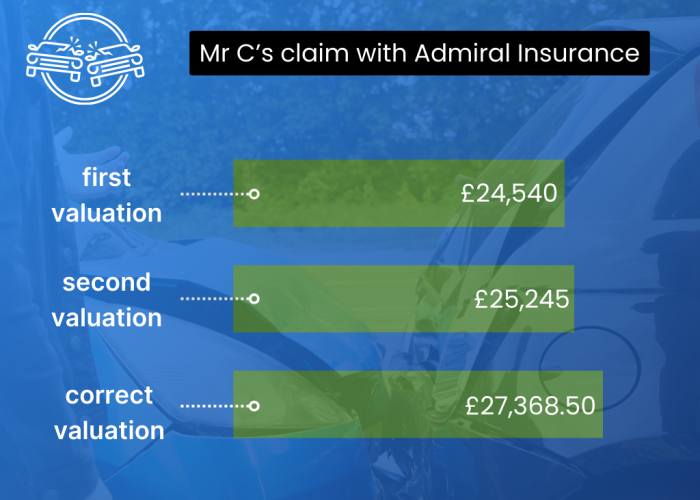

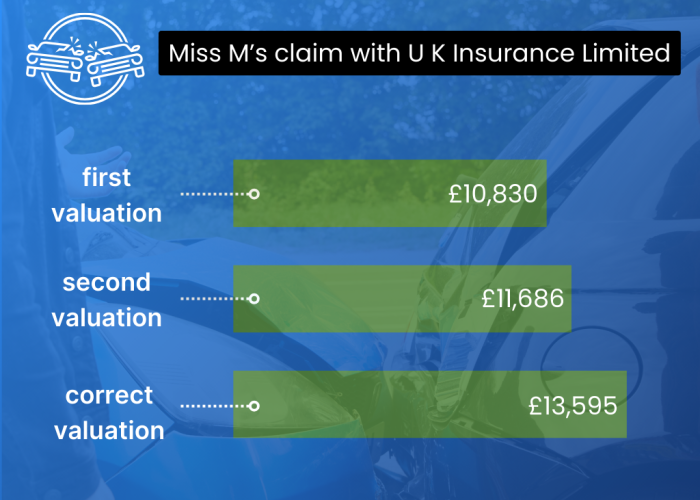

First valuation: This is the insurer’s first valuation of the pre-accident value of the written-off vehicle. Some customers challenge it; some don’t. Of course, no one should have to challenge it – because if the insurer was doing the right thing, it would already be the correct valuation of the vehicle.

Second valuation: When the insurer makes a second valuation, following a customer’s challenge or complaint, you would really hope that it would be right at least second time around. But shockingly, there are examples where the insurer still undervalues the vehicle at this point too.

Correct valuation: Often the UK Ombudsman shouldn’t need to get involved. But if they do, the Ombudsman can determine what the correct and fair valuation is for the vehicle. In the examples we set out below, you can see how the correct valuation (provided by the Ombudsman) is higher than both the insurer’s first and second valuations.

In this example, the UK Ombudsman was especially critical of the insurer’s failure to make a fair settlement, in either the first valuation or the second valuation:

“I think it was completely inappropriate and unacceptable for One Insurance to use a market value of £1,980 originally. And to make matters worse when Mrs M challenged this it only increased the market value to £2,430… I think a fair market value for Mrs M’s car is actually £4,181”[3]

Whether you accepted the first valuation from your insurer, or their second valuation, you might want to consider asking Allegiant Finance for help to see whether you are now due compensation for your insurer failing to value your vehicle fairly:

Let’s look at the other examples of this astonishing behaviour by insurers we are all supposed to trust: use the arrows to scroll.

[1] Reviewed 13 published decisions in 2024: ‘first valuation’ is average of 79.44% of ‘correct valuation’ and ‘second valuation’ is average of 88.05% of ‘correct valuation’ (https://www.financial-ombudsman.org.uk/decision/DRN-4544000.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4534800.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4503187.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4735735.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4749052.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4732685.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4811903.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4716394.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4578870.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4795118.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4776351.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4908793.pdf; https://www.financial-ombudsman.org.uk/decision/DRN-4806703.pdf)

[2] https://www.fca.org.uk/publications/multi-firm-reviews/findings-multi-firm-review-insurers-valuation-vehicles

[3] https://www.financial-ombudsman.org.uk/decision/DRN-4544000.pdf