Allegiant can help you make an unaffordable lending claim against your bank, for irresponsibly providing you with a loan you couldn’t afford to repay. Claims can be made against the major high street banks, including Halifax, Lloyds, NatWest, Nationwide, RBS and Santander – as well as many other loan providers.

The Reputation of Banks vs. Payday Lenders

It is well publicised that ‘Payday’ lenders (many of whom are no longer in business, like Wonga) would grant expensive and unaffordable loans to customers in financial difficulties. There is anecdotal evidence to suggest that such Payday lenders had a bad reputation amongst some people as a result:

Callum: “The fact that needs highlighting is that they’re not only lending irresponsibly, they’re clearly not doing their checks correctly.”

Jennie: “Payday loan companies should all be closed down, people are struggling enough without huge rates on lending.”

Dan: “I work for a bank and the majority of customers account problems are because of payday loan lenders. It’s criminal what they do.”[1]

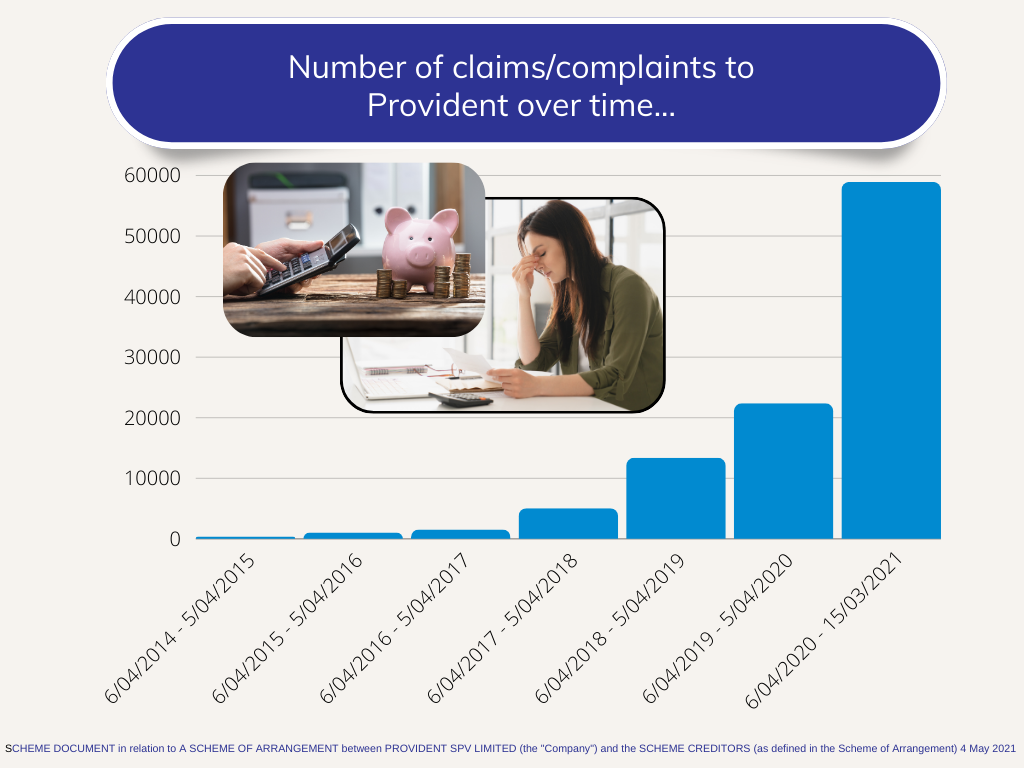

In the past, we’ve seen how unaffordable lending compensation claims against high-cost lenders has escalated over time, as more and more customers realise that they have been mistreated. This visibly happened in the case of the doorstep lender, Provident…

Provident Personal Credit was a major doorstep lender in the UK that specialised in providing small, short-term loans to customers with poor credit histories. It was founded in 1880; it offered high-interest loans, with annual percentage rates (APRs) often exceeding 500%. Loans were typically small amounts (around £300 on average) repaid through weekly home visits by agents. In May 2021, Provident announced it was closing its doorstep lending business due to mounting customer complaints, regulatory scrutiny, and financial struggles.

However, banks (who can also of course provide unaffordable loans) arguably have a better reputation – acting as custodians, keeping your money safe in bank vaults in old and imposing buildings. Whilst the major high street banks were very much embroiled in the Payment Protection Insurance (PPI) mis-selling scandal, they’ve so far perhaps evaded the same scrutiny of their lending practices, to the extent that other lenders – like Provident or Wonga – have faced for their lending decisions.

Here’s an extract from some consumer research into overdrafts which reflects on the reputational position of the banks:

“…because financial institutions have consumers’ money, they have a natural presence and an authority in our society, and therefore, as consumers, we are often more inclined to believe in what they do or say, rather than stop to question it. Many also indicated that the knowledge and expertise in and around overdraft lies with current account providers, and it was both natural and sensible to defer to them as ‘the experts’.”

“You never question it because it’s from the bank…” Unarranged overdraft user, lower income[2]

As we will look at now, do banks really deserve to be seen as the safe pair of hands when it comes to responsible lending, and treating customers right?

Online Loan Applications: A False Sense of Security

Many people understand that if you are looking to buy insurance, or make an investment, the service you receive from the company online is going to be very different to if you had a face-to-face meeting with that same financial services provider. In a face-to-face meeting, you might expect to be given tailored advice to your needs and circumstances, whereas buying the same product online, there’s inevitably more onus on the customer to make decisions which are right for them.

But the same does not apply when borrowing money! In fact, the rules around responsible lending are the same for banks whether or not a loan is given online or during a face-to-face meeting. As one Ombudsman explained:

“[TSB] appears to have suggested that, as the application took place online, Mrs W was responsible for ensuring the monthly payments were affordable for her. But I’m not aware of anything in the rules and regulations, or even the industry codes of practice, which state, or even infer, that lesser standards or a lesser duty of care applies to affordability assessments conducted for online applications. So to be clear and for the avoidance of doubt as the regulated firm here it was TSB’s responsibility to assess whether the payments were affordable, notwithstanding the fact that Mrs W made this application online.”[3]

So, if you have taken a bank loan online, it could be that your bank did not do the proper checks it ought to have done, to ensure that the loan repayments would be sustainably affordable for you.

The Importance of Checking Bank Statements

If you apply for a loan with the bank you have your current account with, you might assume that your bank would look at your statements before granting a loan. But this is not always the case. As one Ombudsman explained:

“I couldn’t see that Halifax verified Miss W’s declared income and housing costs, even though it had access to her bank statements… Halifax should have used Miss W’s bank statements, to which it had access, in order to carry out proportionate checks… proportionate checks would have shown Miss W would have had little or no disposable income after the loan repayment and that it was irresponsible to have approved the loan, given what Halifax should have known about Miss W’s financial circumstances.”[4]

If banks do not check bank statements, they run the risk of missing ‘red flags’ on bank statements, such as excessive gambling. Missing these can then lead to an irresponsible lending decision, which ends up really harming the customer and their finances. One Ombudsman outlined their worry:

“Zopa has said the checks its systems are designed to run to would never have picked up on the fact Mr G was gambling extensively or taken these into consideration before approving an application for credit. I find this admission extremely worryingly. The rules set out by the Financial Conduct Authority (FCA) for lenders state that they need to consider not only affordability but also the sustainability of any credit provided to consumers. And part of that latter consideration will be reviewing the lines of credit already available to the consumer, what they’re being used for and how they’re managing their finances generally. By designing its systems to never review gambling transactions Zopa is at serious risk of providing credit to extremely vulnerable consumers and causing serious harm to them. I would respectfully suggest that if its systems genuinely never consider any signs of compulsive spending before approving credit applications it needs to revisit those systems and review whether or not they are fit for purpose.”[5]

Here to help

If you choose Allegiant to assist with your claim, you’re in experienced hands. We’ve submitted more than 118,000 unaffordable lending claims!

There are certain time limit rules in place, so if you want to start a claim, it’s probably better to start it sooner rather than later. If it has already been some years since you took your bank loan out, we recommend raising your claim within 6 years of the loan finishing.

[1] https://www.bbc.co.uk/news/newsbeat-22690552

[2] https://www.fca.org.uk/publication/research/fca-overdraft-proposals-consumer-research.pdf

[3] https://www.financial-ombudsman.org.uk/decision/DRN-3178758.pdf

[4] https://www.financial-ombudsman.org.uk/decision/DRN-4402324.pdf

[5] https://www.financial-ombudsman.org.uk/decision/DRN-4400928.pdf