The rules mean that there are certain time limits which must be met when a Scam Claim is made. If you ignore these time limits, it may mean that your Scam Claim cannot be investigated.

This blog will explain these time limits by using some hypothetical examples.

6 month time limit

Mr A writes a letter of complaint to his bank, because he thinks his bank should have done more to monitor his bank account and stop Mr A being scammed.

Mr A’s bank writes back to Mr A with a ‘Final Response’ letter. The bank does not think it has done anything wrong.

Unhappy with the bank’s response, Mr A wants to take his complaint to the Financial Ombudsman Service. The important time limit here is that Mr A has 6 months from the date of the Final Response letter to take his complaint to the Financial Ombudsman Service.

6 year and 3 year time limits

The Financial Ombudsman Service will not investigate a Scam Claim if it is brought to them more than:

- six years after the Scam happened; or (if later)

- three years from the date on which the Scam victim became aware (or ought reasonably to have become aware) that they had cause for complaint about the Scam.

These timescales can also apply if you are looking to the Courts to resolve your dispute.

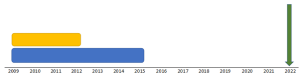

Dr B was a victim of a scam in 2009.

Dr B also realised in 2009 that she had been a victim of a scam.

The rules mean that she had 6 years to make her complaint, so she needed to complain no later than 2015.

But Dr B did not make a complaint (a Scam Claim) until 2022. She was therefore too late and out of time.

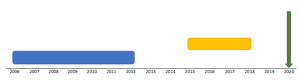

Miss C was a victim of a scam in 2006, although it wasn’t obvious that it was a scam at the time.

In 2015, Miss C found out that what happened in 2006 was in fact a scam.

Miss C made her Scam Claim in 2020. This meant that she was too late to complain, as she should have done so no later than 2018. Her claim therefore couldn’t be investigated under the rules.

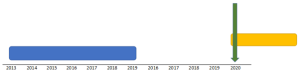

Ms D was a victim of a scam in 2013. But it wasn’t obvious that it was a scam when it happened.

It came to light that it had been a scam in 2020. Ms D made a Scam Claim as soon as she realised this in 2020.

This complaint was made in time, and will be investigated.

If Allegiant are assisting you with a Scam Claim, we will advise you on the relevant time limit rules.