First version posted: 14 February 2022 | Updated: 4 October 2024

When a new unaffordable lending claim is made, two of the key questions the lender should be asking themselves are:

- Was the claim/complaint made in time under the ‘time limit’ rules?

- If it was made in time, was the lending unaffordable?

The time limit rules are not clear-cut and can be open to some interpretation. If you have made an unaffordable lending claim before, you may have experienced the lender saying that the claim has been made too late. You may have received a letter from the lender including this kind of wording:

“You have the right to refer your complaint to the Financial Ombudsman Service, free of charge.

The Ombudsman might not be able to consider your complaint if:

- what you’re complaining about happened more than six years ago, and

- you’re complaining more than three years after you realised (or should have realised) that there was a problem.

We think that your complaint was made outside of these time limits but this is a matter for the Ombudsman to decide. If the Ombudsman agrees with us, they will not have our permission to consider your complaint and so will only be able to do so in very limited circumstances…”

(https://www.handbook.fca.org.uk/handbook/DISP/1/Annex3.html)

But we have seen examples where – once the case reaches the Ombudsman – the claim is in fact considered in time, not out of time. This shows the importance of not necessarily accepting what the lender says at face value. Here is an example of an Ombudsman overruling the lender on time limits:

“So, I think Miss M complained in time about loans 3 to 22 because she complained within three years of becoming aware, or when she ought to have been aware, of the reason she’s now complaining. I think therefore that we can look at her complaint about loans 3 to 22”

(https://www.financial-ombudsman.org.uk/decision/DRN-2293573.pdf)

If you have made a claim about unaffordable lending before, you may have been asked certain questions by the Financial Ombudsman Service, such as:

- When did you realise you had suffered loss from unaffordable lending?

- What was it that made you aware of this?

- Why didn’t you complain sooner?

These kinds of questions are normal. Remember, they are to do with whether the claim is in time, not to do with whether or not the lending was actually affordable or not (the investigation into affordability would start if it is established that the claim is being made in time).

Time on your side?

If you have already realised that you are potentially a victim of irresponsible lending, it’s a good idea to not wait too long before making your claim. Your claim may be rejected if it is deemed you’ve been ‘sitting on your hands’, knowing that you should claim, but not taking any action.

Furthermore, it is difficult to predict what will happen in the future. There have been instances of major lenders in the past, like Wonga, going bust and it then being too late to make a claim for compensation against the lender. In the case of Wonga, it wasn’t the time limit rules, but instead its collapse meant that it simply had no money to pay compensation to victims of irresponsible lending.

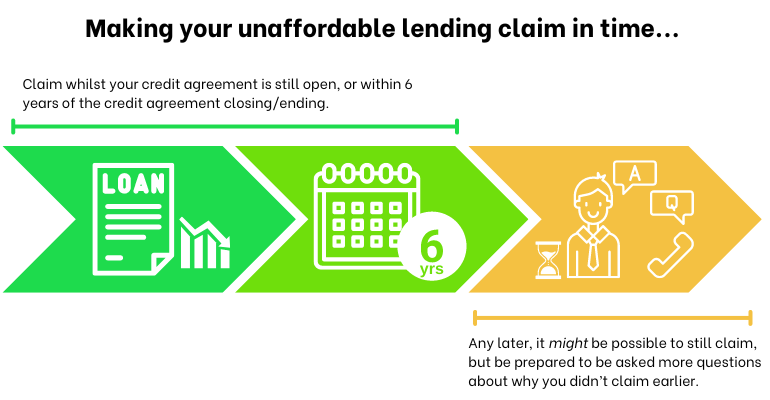

Whilst we cannot make any promises or guarantees about the interpretation of the time limit rules, our advice is based on outcomes we’ve seen from the Financial Ombudsman Service. Allegiant therefore advises that a claim is well worth making if:

- The lending (the credit agreement) you wish to claim about is still open and live; or

- It is within 6 years of the credit agreement ending.

We’ve seen examples where a claim is started more than 6 years after the credit agreement has ended, and these can be unfortunately deemed to have been made too late by the Financial Ombudsman Service.

Another consideration is if the lender has sold on your outstanding debt to a third party, so the lender is no longer the owner of the credit agreement. If the debt has been sold on, it can impact on the length of time you have to raise your unaffordable lending claim in time under the rules.

Claim evidence

If your claim is deemed to be ‘in time’, an investigation should be conducted into whether or not the lending was unaffordable for you.

But if neither you nor your lender has much evidence of the lending – because the lending happened many years ago – it might be challenging to get a successful claim outcome. And it is unlikely that a lender will be expected to pay out compensation solely because they’ve no longer retained the relevant documents from many years ago.

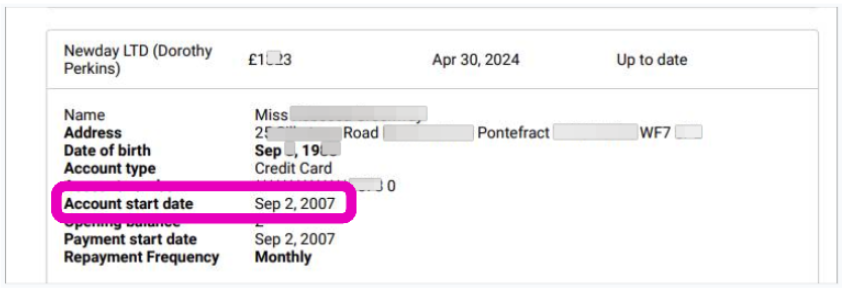

However, the idea that all financial information is wiped off after 6 years is a bit of a myth. And whilst it might be a little harder to gather claim evidence from many years ago, your credit report and bank statements may still act as valuable evidence for your unaffordable lending claim.

For instance, we have examples of Allegiant customers providing over 7 years of bank statements. Also, the below customer credit report was created in May 2024, but contains information about credit agreements starting as long ago as 2007:

Here to help

Allegiant have extensive experience of unaffordable lending claims, and the associated time limit rules.

If Allegiant is assisting you with a claim, we would be happy to advise you more on whether or not we think time is on your side.