If you’ve recently taken out a car loan and are struggling to meet the repayments, or if you feel the terms of the loan were not fully explained to you, it’s possible that you’ve been mis-sold car finance.

Mis-selling in car finance typically refers to situations where the loan was unaffordable or where undisclosed commissions were involved, leading to you being offered terms that weren’t in your best interest. In recent years, there have been other major mis-selling scandals, such as the widespread mis-selling of Payment Protection Insurance (PPI). You may also have read about mis-selling in car finance in the news.

Unaffordable Car Loans

When a lender offers you a car loan, they are legally required to conduct thorough checks to ensure you can afford the repayments. A car loan can be a significant commitment, often taking up a large portion of your monthly income, so it’s vital that the terms are fair and manageable.

Consider the case of Miss B[1]:

- The total amount payable over 4 years was more than £35,000.

- Monthly repayments were around £514, with a final lump sum payment of £9,868.

- However, Miss B was only working part-time, earning just under £596 a month.

- After her loan repayments, she was left with only £80 for essential living costs, including running the car.

This scenario highlights a significant problem: affordability checks were either not properly carried out or were inadequate. Lenders have a responsibility to complete rigorous affordability assessments before approving finance agreements. Unfortunately, Miss B’s case is just one of many where this didn’t happen.

People are increasingly turning to Personal Contract Purchase (PCP) agreements to fund their car purchases. While PCP can offer attractively low monthly payments, it’s important to note that the overall cost over the life of the agreement can be high due to interest charges and the large final payment.

If you think your car loan or PCP agreement was unaffordable, you could start a claim and benefit from Allegiant’s experienced assistance.

Hidden Commission and Undisclosed Fees

You may have heard about “hidden commission claims” in relation to car finance. This refers to car dealerships using increased interest rates to receive a commission from the finance company they introduce you to.

When you visit a dealership to buy a car on finance, you might expect to be introduced to the best possible finance deal for your circumstances. However, in some cases, the dealership may select a lender based on the commission they will receive, rather than whether the loan is actually the most suitable or affordable for you.

Most people accept that car dealers make a profit when selling a car, but what they might not realise is that the lender could be paying the dealership a commission for the introduction. This could result in higher monthly payments or less favorable terms for you. Instead of acting in your best interests, the dealership could be prioritising its own profits.

For a real-life example, you can take a look at one of our other blogs: The Story of Ms. Lewis and Hidden Commission.

How Vulnerable Customers Are Affected

A common thread with car loan mis-selling is that vulnerable customers particularly suffer.

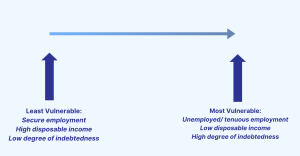

Above: the vulnerability scale[2]

A judge in a recent court case (October 2024) confirmed that customers who take out car loans are more vulnerable than those who have the financial ability to buy a car outright:

“The claimants needed the finance to be able to afford to acquire the car they wanted, which made them more vulnerable than someone who might have had the choice to pay in cash.” [3]

This vulnerability extends beyond just financial capability. Many customers may struggle to fully understand the small print, financial jargon, or hidden clauses in their finance agreements. This creates a significant power imbalance: the dealership and lender have a deep understanding of finance agreements, while many customers do not.

Some argue that since only adults can take out car loans, they should be responsible for their own decisions. While this is true to some extent, it ignores the issue of mental bandwidth—a concept particularly relevant to more vulnerable customers.

Being financially strained is like a computer struggling to run multiple programs at once. It’s not that the person lacks intelligence; rather, they are burdened by the constant stress of making ends meet[4]. This mental overload can lead to rushed or uninformed financial decisions, increasing the likelihood of being mis-sold a car loan.

Many lenders are beginning to acknowledge these issues and are working towards greater transparency with their customers. However, those who fail to meet their obligations may find themselves owing their customers compensation for mis-selling and mistreatment.

The Mental Toll of Financial Pressure

It’s important to recognise that financial pressure can have a real impact on a person’s mental wellbeing. People who are struggling financially may feel overwhelmed by constant worries about how to make ends meet, which can make it harder to make informed decisions about things like car finance.

When someone is juggling multiple financial pressures, they may make decisions under duress, potentially leading to a loan agreement they cannot afford. Unfortunately, this imbalance in knowledge and mental bandwidth is something that many customers face when dealing with car finance.

What You Can Do

If you think you’ve been mis-sold a car loan due to unaffordable lending or hidden commission payments, you might be entitled to compensation. At Allegiant, we specialise in helping individuals who feel they’ve been treated unfairly by lenders or car dealerships.

We’re here to guide you through the claims process and aim for you to receive the fair treatment and compensation you deserve. Get in touch with us today to learn more and find out how we can assist you.

[1] https://www.financial-ombudsman.org.uk/decision/DRN-4978468.pdf

[2] Christine Riefa and Séverine Saintier (eds), Vulnerable Consumers and the Law: Consumer Protection and Access to Justice (Routledge 2021) 87

[3] https://www.judiciary.uk/wp-content/uploads/2024/10/Johnson-v-Firstrand-Bank-and-Hopcroft-v-Close-Brothers.pdf

[4] Rutger Bregman, Utopia for Realists (Bloomsbury 2017) 57.