Moneybarn Refund: Irresponsible Lending Example

Below is a real life example of a successful claim, which we’ve anonymised to protect the customer’s identity (we will call them simply Mr C).

Mr C came to Allegiant as they wanted to make a Moneybarn claim for irresponsible lending. They told us that the finance with Moneybarn was taken out (to buy a car) in 2020. Mr C recalls that they had take-home pay of around £1,200 per month, but were dedicating at least £500 to existing borrowing commitments. Nr C felt Moneybarn had engaged in irresponsible lending.

Allegiant sent the claim to Moneybarn. Moneybarn responded to say that it felt it had lent the finance responsibly:

– ‘Your existing borrowing levels were within our lending criteria.’

– ‘Your credit file did not raise any concerns regarding signs of financial distress.’

– ‘I am satisfied that the checks that were completed at point of sale were adequate, proportionate and the decision to lend the finance was dependant on the information obtained from the Credit Reference Agencies, information obtained by the Office for National Statistics and your declaration under the terms of your contract that stated that the agreement was and would be affordable for you, thereafter.’

Allegiant then advised Mr C that we could take their claim to the Financial Ombudsman Service, but that Mr C should provide their credit report and bank statements as evidence that unaffordable and irresponsible lending had taken place.

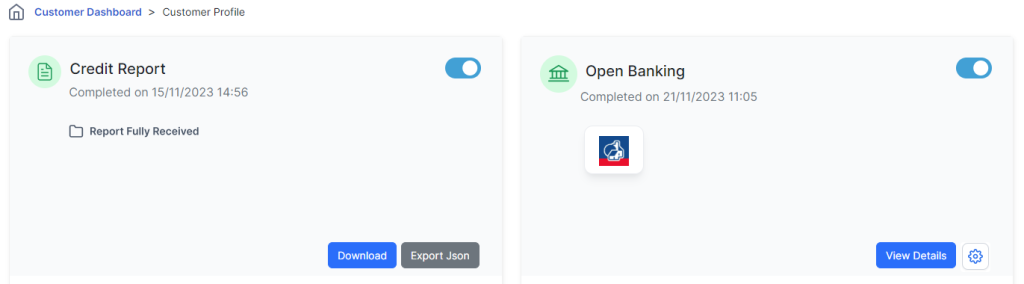

Allegiant Portal allows customers to consent to quick and easy review of their open banking and credit report, to search for signs of affordability issues.

In November 2023, Mr C was invited to sign up for Allegiant Portal. Mr C accepted the invite and connected their bank account. This gave Allegiant read-only access and the key information needed to prove unaffordable lending by Moneybarn.

An Investigator from the Financial Ombudsman Service was provided with the relevant bank statements, and made the following findings:

‘Moneybarn could have reviewed Mr C’s bank statements in order to verify his income and outgoings. I’ve reviewed his statements for the months before the agreement. I can see his monthly income was around on average around £1,343. I’ve also calculated his outgoings for housing, bills and other regular payments. This was at least £1,000. It’s also important to note that his statements showed a lot of returned direct debits.

Based on this, I don’t think the credit was affordable or sustainable for Mr C at the time. So, I don’t think the credit should have been provided. The agreement was lent irresponsibly.’

In December 2023, Moneybarn confirmed that they accepted the Investigator’s assessment that the finance was given irresponsibly. To put things right, they offered Mr C a compensation payout of around £1,500. This was made up of the deposit for the car and the interest paid on the finance agreement.

In summary, Mr C had agreed to read-only access to his bank statements, which allowed the Financial Ombudsman Service to see the evidence that the Moneybarn finance agreement was not affordable and not provided responsibly.

Finally, its important to say that not all Moneybarn lending decisions are incorrect. A claim against Moneybarn requires them to have made a wrong decision (which can occur from time to time), and for a customer to provide robust evidence.