In this blog, we look at some of the questions people have when they are weighing up whether to start a write-off claim with us.

Can I win compensation?

That depends on the individual circumstances of your case, and we never guarantee success. What we can promise is no upfront fees, and that we are seeing real customers winning real compensation when they make a claim with Allegiant.

Will my insurer contact me to pay compensation without me making a claim?

Publicly available information suggests that only a small minority of motorists will be proactively contacted by their insurer and offered compensation. This means that motorists need to think very carefully about waiting for their insurer to come to them.

The Financial Conduct Authority (FCA) reported in September 2025 that 270,000 motorists are due to receive compensation by being proactively contacted by their insurer.[^1] But 270,000 is a very small proportion of the estimated 42 million UK driving licence holders.[^2]

In that press release, the FCA specifically referenced only two insurers — Direct Line and Admiral — as proactively contacting customers to pay compensation for under-settled write-off claims. There is no publicly available information about whether other insurers plan to do the same.

We also know that Admiral are only planning to contact approximately 3% of their customers, whereas our analysis suggests that considerably more than 3% of Admiral customers are due compensation.[^3]

Will the FCA run a redress scheme?

You may have heard that the FCA are planning a compensation scheme for undisclosed commission arrangements connected to motor finance agreements. If it goes ahead, this will mean lenders will need to compensate certain customers.

Some motorists might wonder whether there will also be a redress scheme for insurers who have under-settled write-off payouts.

We cannot rule out that the FCA will eventually decide on such a scheme, but there are currently no plans for one. The FCA have said: “We can never rule out firms having to pay redress for serious misconduct, but there are no further mass redress events on our radar.“[^4]

There is also a practical difficulty. Fair insurance payouts depend on a wide variety of factors — the make, model and mileage of the vehicle, and the shape of the second-hand car market at the time of the write-off. A one-size-fits-all compensation scheme would be very difficult to achieve. That is why Allegiant helps customers on a case-by-case basis.

Will my car insurance premiums increase?

This is one of the most common worries we hear. Drivers often fear that if they “rock the boat” by challenging a valuation, they will be punished with a higher premium at renewal.

However, the evidence suggests this fear is largely misplaced.

The key point is the difference between an incident and a valuation. When your car was written off — whether through an accident, theft, or fire — that incident was recorded on the Claims and Underwriting Exchange (CUE).[^5] Your insurer assessed the risk at that point, and that risk is what drives your premium.

When you challenge a write-off offer, you are not declaring a new incident or changing your risk profile.[^6] You are asking for a correction to the amount you were paid. Whether the insurer pays you £8,000 or £10,000, the fact that you had a claim remains the same. If there was going to be a premium impact from the incident, you have likely already incurred it.[^7] Accepting a low offer does not reverse that — it simply means you are underpaid for a claim that is already on your record.

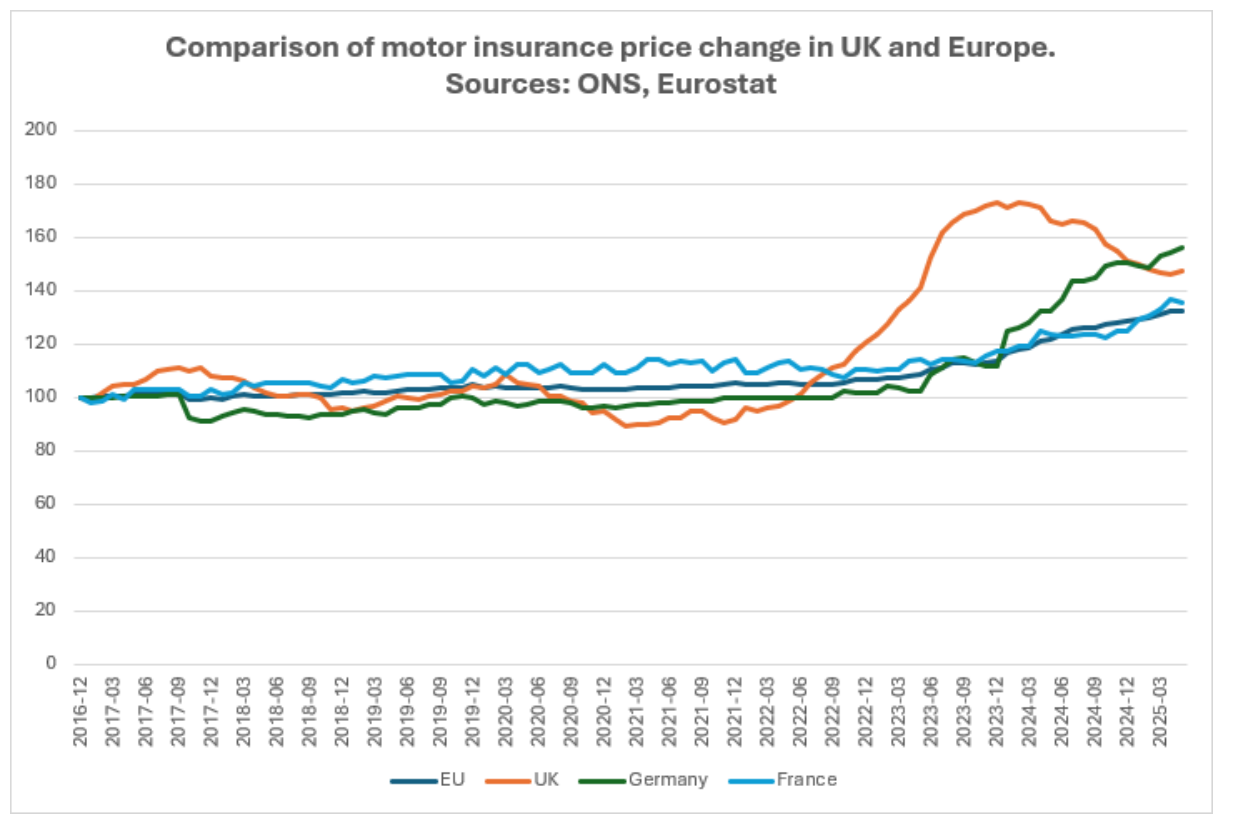

Some people worry that if more customers challenge low offers, premiums will rise for everyone. The government’s Motor Insurance Taskforce Final Report (December 2025) shows this is not how it works.[^8]

The Taskforce found that the significant premium increases between 2022 and 2024 — prices rose by over 25% in a single year[^9] — happened even though the total number of claims actually fell.[^10] The driving force behind expensive premiums is not customers claiming fair payouts. It is inflation in the cost of repairs and replacements.[^11]

The report highlights some of the factors at play: repair costs have risen by over 30% since 2022 due to energy, paint and parts prices[^12]; theft payouts are up 20% due to the targeting of high-value vehicles[^13]; and modern cars require expensive specialist work because of ADAS sensors and complex technology.[^14] A bumper repair that cost £500 five years ago can now cost over £1,500.[^15]

In 2023, for every £1 insurers received in premiums, they paid out roughly £1.14 in claims and operating costs.[^16] That loss was driven by global inflationary pressures,[^17] not by customers successfully challenging low write-off offers.

If your insurer has undervalued your car, that is money you are entitled to.[^18] You should not leave it on the table because of a concern about premium rises that have already happened for entirely different reasons.

—————————

Sources:

[^1]: FCA (September 2025). Over 270,000 motorists receive motor insurance compensation from insurers. https://www.fca.org.uk/news/press-releases/over-270000-motorists-receive-motor-insurance-compensation-insurers

[^2]: Driving.org. Record-high UK driving licence holders soar. https://www.driving.org/record-high-uk-driving-licence-holders-soar/

[^3]: Allegiant. Admiral Insurance write-off claims analysis. https://allegiant.co.uk/vehicle-write-off-claim/admiral-insurance/

[^4]: FCA (2025). Consultation Paper CP25-27, page 12. https://www.fca.org.uk/publication/consultation/cp25-27.pdf

[^5]: Aviva/MoneySupermarket (2025). Claims and Underwriting Exchange (CUE) – Motor Insurance Database. Multiple sources confirm CUE’s role in recording insurance incidents.

[^6]: Financial Ombudsman Service (December 2024). Vehicle valuations and write-offs. https://www.financial-ombudsman.org.uk/consumers/complaints-can-help/insurance/motor-insurance/vehicle-valuations-write-offs

[^7]: CompareTheMarket (January 2025). How Non-Fault Claims Affect Insurance. https://www.comparethemarket.com/car-insurance/content/do-non-fault-claims-need-to-be-declared/

[^8]: UK Government (December 2025). Motor Insurance Taskforce: Final Report. https://assets.publishing.service.gov.uk/media/6938493f6a12691d48491c9e/motor-insurance-taskforce-final-report.pdf

[^9]: DWF Group (August 2025). FCA Motor Claims Cost Review. Citing Motor Insurance Taskforce findings on premium increases 2022-2024.

[^10]: Motor Insurance Taskforce Final Report (December 2025). Claims frequency decline during period of premium increases.

[^11]: DaC Beachcroft (December 2025). The Motor Insurance Taskforce: final report and actions has landed. https://www.dacbeachcroft.com/en/What-we-think/The-Motor-Insurance-Taskforce-final-report-and-actions-has-landed

[^12]: ABI (January 2024). Motor Insurance Premiums Continue to Rise as Insurers Battle Costs. https://www.abi.org.uk/news/news-articles/2024/1/motor-insurance-premiums-continue-to-rise-as-insurers-battle-costs/

[^13]: ABI (August 2024). Motor insurers pay out record amounts to help keep motorists mobile. https://www.abi.org.uk/news/news-articles/2024/4/motor-insurers-pay-out-record-amounts-to-help-keep-motorists-mobile/

[^14]: DaC Beachcroft / Motor Insurance Taskforce Final Report (December 2025). Impact of modern vehicle technology (ADAS sensors) on repair costs.

[^15]: ERS (2024). The impacts of claims inflation on motor insurance – Claims Inflation Guide 2024. https://www.ers.com/assets/img/documents/ERS-Claims-Inflation-Guide-2024.pdf

[^16]: ABI (January 2024). Motor Insurance Premiums Continue to Rise as Insurers Battle Costs. Combined ratio and underwriting loss data for 2023.

[^17]: Insurance Times (July 2024). Motor insurers record major losses in 2023. https://www.insurancetimes.co.uk/news/motor-insurers-record-major-losses-in-2023-but-profitability-expected-to-return/1452457.article

[^18]: FCA (December 2025). Findings of multi-firm review into insurers’ valuation of vehicles. Consumers entitled to fair market value for written-off vehicles. https://www.fca.org.uk/publications/multi-firm-reviews/findings-multi-firm-review-insurers-valuation-vehicles