Recent statistics suggest that customers of digital banking disruptor Revolut are more likely to fall victim to scams compared to traditional banks. Based on a Freedom of Information request made by the BBC, Revolut topped the fraud leader board, being named in nearly 10,000 fraud reports to Action Fraud in 2023. This significantly exceeds reports from other established high-street banks like Barclays UK and Lloyds, which were cited in approximately 8,000 cases each. In contrast, fellow fintech Monzo was mentioned in about 5,000 incidents.

Increasing Fraud Complaints for Revolut in 2023

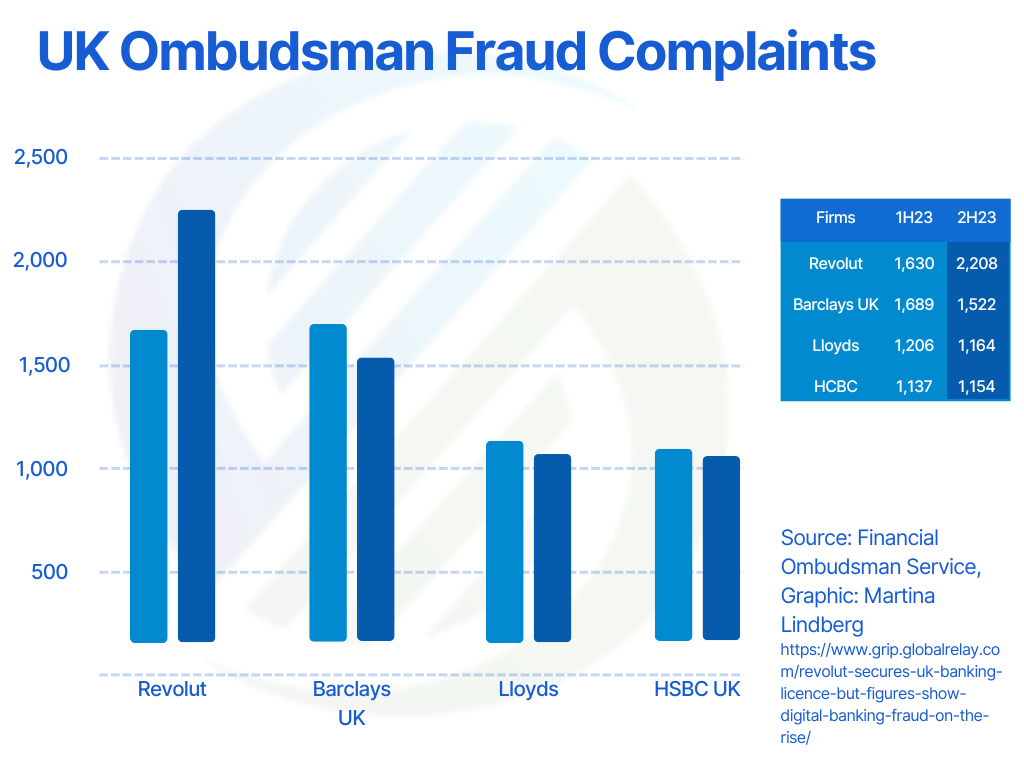

This marks a significant increase from the 1,630 complaints reported in the first half of the year, while other banks have successfully reduced their numbers.

Revolut has a poor record of reimbursing victims of Authorised Push Payment (APP) fraud and leads in scam-related complaints to the Financial Ombudsman Service (FOS), with over 3,500 complaints filed in 2023. This was almost 50% more than Barclays UK and nearly double the complaints received by Lloyds and HSBC. In nearly half of all cases reviewed and closed last year, the ombudsman decided in the victim’s favour.

Ombudsman Service, Graphic: Martina Lindberg

Revolut’s Poor Record of Scam Reimbursements

Revolut has been criticised for the high volume of scam payments received into its customers’ accounts. In 2023, for every £1 million in transactions, £756 were linked to APP scams, significantly higher than traditional banks like Barclays, where this figure was only £67, or rival fintech companies like Monzo and Starling. This places Revolut among the top receivers of scam-related transactions. Additionally, Revolut reported receiving 537 APP scam payments per million transactions, further highlighting its vulnerability to fraud.

Key fraud figures for Revolut in 2023:

- 9,793 fraud reports made to Action Fraud.

- 3,500 complaints filed with the Financial Ombudsman Service.

- £756 in APP scams for every £1 million in transactions.

- 537 APP scam payments per million transactions.

Did Revolut Fail to Refund You Money Lost to a Scam?

A major criticism of Revolut is its slow response to fraud incidents, often relying on app-based support rather than immediate assistance via a dedicated helpline. In some cases, such as with a customer who lost £165,000 in minutes, delays in contacting the right department resulted in further losses.

Although Revolut claims to have robust controls and fraud detection systems, including AI-driven tools that analyse over half a billion transactions each month, its reimbursement practices and the volume of scams associated with its platform suggest significant room for improvement.

Allegiant are experts in helping customers fight their claims and win the compensation they deserve. If you have been a victim of a scam with Revolut that they failed to resolve fairly or you prefer to have a knowledgeable third party acting on your behalf when making a complaint, then Allegiant can help.

You are in safe hands with Allegiant, we could help you with any eligible scam or fraud reimbursement claim

Sources:

- Which? News – New details emerge on Revolut fraud complaint deluge

- Payment Systems Regulator (psr.org.uk) – APP fraud performance data 2023

- BBC – Revolut secures UK banking license, but figures show digital banking fraud on the rise

- Financial Ombudsman Service

- Grip Global Relay – Revolut Secures UK Banking License