Don’t Let Insurance Companies Keep Your Money

You’ve Already Lost Your Car – Don’t Lose Your Money Too

When your insurance company declared your written-off car a total loss, did you feel they shortchanged you on the insurance payout? You’re not alone. Many drivers discover their payout was less than expected, leaving them underpaid by hundreds – sometimes thousands – of pounds[1] for their damaged vehicles.

Your Money is Still Out There. We Could Help You Get It Back.

If you had a written-off vehicle and received an undervalued insurance claim settlement, Allegiant is here to help recover the money you should have received. We can prove to the insurer that your insurance payout was too low by gathering evidence and documentation to support your claim. We guarantee No Upfront Fees, and you only pay us if we successfully reclaim your missing money from your insurance company.

If You Lost Out, Your True Settlement Amount Could Still Be Recoverable

Think about that hollow feeling when you sell something for less than it’s worth – that’s exactly what may have happened with your car insurance settlement. The difference is that insurance companies are regulated and shouldn’t be undervaluing your car or expecting you to haggle over the valuation, yet this still happens in some cases.

The money you lost isn’t gone forever. If your vehicle was declared a write-off within the last 6 years, you may be eligible to recover the underpayment from your insurance company.

Real Customers Who Reclaimed Their Lost Money

These are genuine customers who Allegiant helped recover underpayments – no stress required once they decided to claim:

Mr A started his claim with Allegiant in January 2025 for his Mazda written-off car in July 2023. Aviva admitted they undervalued his car and paid him an additional £1,155 – money that was rightfully his all along.

Mr B contacted us in February 2025 about his Land Rover that suffered substantial damage in October 2020. Ageas agreed to re-value the vehicle, returning £1,042 to his pocket.

Miss C started her claim in February 2025 for her Vauxhall Corsa total loss in June 2021. Admiral agreed to make things right, paying her £1,037 in missing compensation.

Mr D reclaimed £905 from Hastings Direct for his Volkswagen Golf written-off vehicle in September 2021 – money he should have received years ago.

What is a Car Write-Off and Why You May Have Lost Money

A vehicle write-off occurs when repair costs exceed your car’s value or it’s deemed an uneconomical repair. Insurers use the vehicle’s market value and the value of the vehicle to determine if it should be declared a write-off. Insurance companies then offer compensation based on your car’s pre-incident market value – but they don’t always get this valuation right.

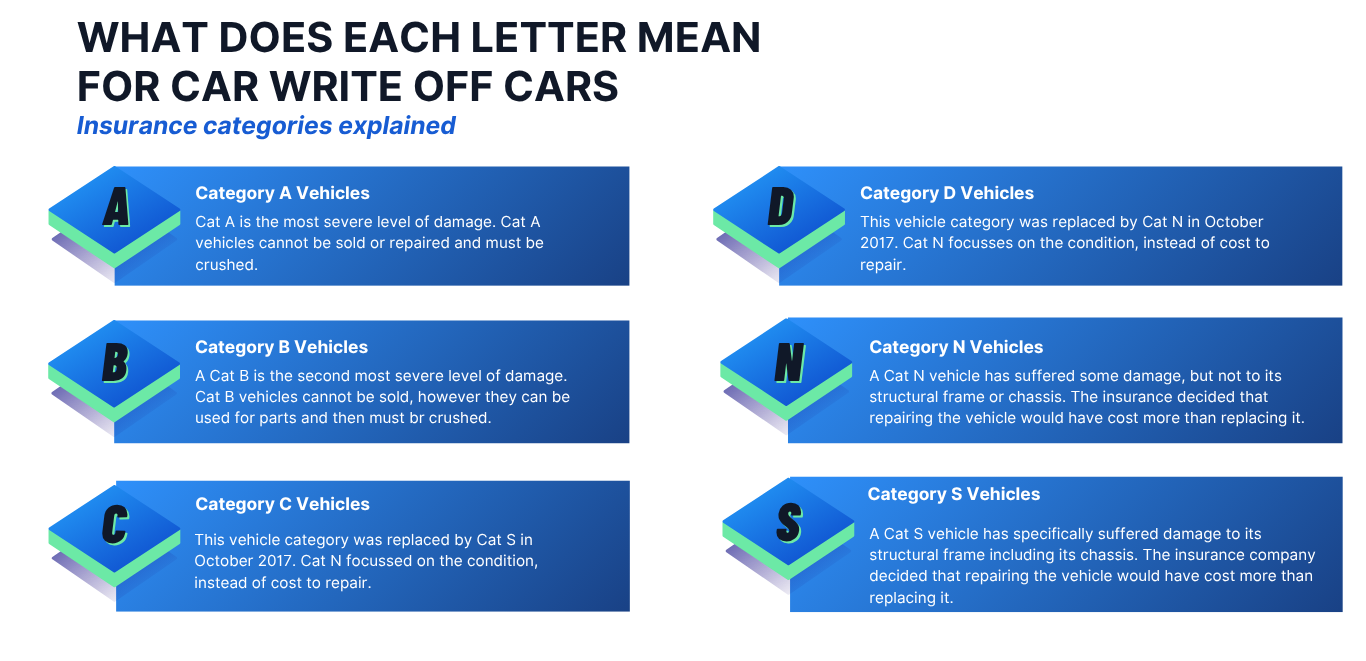

There are four categories of write-offs that have evolved over time to better reflect the type of damage:

Current Write-Off Categories:

- Category A (Cat A): Severely damaged, must be crushed completely – entire vehicle destroyed.

- Category B (Cat B): Severely damaged, but some other parts salvageable from the body shell.

- Cat S (Cat S): Vehicles that have suffered structural damage such as a bent chassis or collapsed crumple zones. These require professional repair to restore roadworthy condition.

- Category N vehicle( Cat N): Non-structural damage that doesn’t affect the vehicle’s structural integrity but may be an uneconomical repair.

Legacy Categories:

- Category C (Cat C): Repairable total loss where repair costs exceeded the car’s value, but vehicle can be restored to roadworthy condition.

- Category D (Cat D): Minor damage, economical repair possible.

The extent of damage to damaged vehicles, including the body shell and other parts, affects the write-off category and salvage process. Insurers deal with disposal or salvage of written-off vehicles, which impacts the vehicle’s future use, insurance eligibility, and value. Some previously written-off vehicles enter the motor trade section for part exchange or are sold for parts.

Common Causes Requiring Total Loss Claims:

- Road traffic accidents resulting in badly damaged vehicles

- Vehicle theft where cars are stolen and not recovered

- Vandalism and criminal damage

- Weather damage (floods, storms, hail) causing substantial damage

The Potential Scale of Underpayments in the UK

Between 2019 and 2024, over 3 million cars were written off in the UK. This would have resulted in some owners receiving less than their vehicles were worth, losing money they’ll never know about unless they enquire. The cost to customers could be significant.

| Year | Cars Written Off |

|---|---|

| 2019 | 556,418 |

| 2020 | 414,593 |

| 2021 | 449,737 |

| 2022 | 524,321 |

| 2023 | 559,870 |

| 2024 | 562,185 |

| Total | 3,067,124 |

Determining the True Market Value of Your Vehicle

When your car is subject to total loss claims, knowing its true market value is essential to ensure you receive a fair insurance payout. Market value is the price your vehicle would fetch if sold on the open market just before the accident or incident. Allegiant is here to help you with all this.

How Insurers Determine Value

Insurance companies typically assess market value by consulting industry price guides, reviewing recent sales of similar vehicles, and considering the car’s make, model, age, mileage, and overall condition. They examine the vehicle’s history, including any previous accidents, repairs, or if it was previously written off.

A Category N vehicle may retain more value than a Cat S vehicle due to the nature of structural damage sustained. The vehicle licensing agency (DVLA) records also matter when assessing value. What matters most for your finances is the value your vehicle had immediately before the accident — not its worth as salvaged wreckage — because the pre-incident value determines how much you receive from your insurance settlement.

Challenging Low Valuations

The insurance company’s assessment isn’t always final. If you believe their payout value is too low, you have the right to challenge it before accepting the settlement. You can prove your case by gathering evidence that your vehicle is worth more than what your insurance company says it is worth:

- Maintenance records showing the vehicle’s care

- Receipts for recent repairs or improvements

- Examples of similar cars currently for sale in the market

- Independent professional valuations

- Evidence the vehicle was in excellent roadworthy condition

When dealing with a finance company, additional considerations may apply to the insurance claim process.

If you have already received a payout you believe is too low, and didn’t challenge it at the time, this is where Allegiant can step in and help you recover your past losses.

Why Insurance Companies Undervalue Vehicles

Insurance companies sometimes use insufficient pricing data or conservative valuations to minimise insurance payouts, creating discrepancies with your car’s true market value. This practice can result in insured customers receiving unfair compensation. The Financial Conduct Authority (FCA) has warned insurers about this:

“When making an insurance claim, people shouldn’t need to question whether they are being offered the right amount for their written-off car or other goods that they need to replace. Insurance firms should offer settlements at the fair market value. This is especially important now as people struggling with the cost of living will be hit in the pocket at precisely the time they can ill afford it.” – FCA[2]

Time Limits: Don’t Lose Your Right to Claim

Act before it’s too late. Insurers and regulators set clear time limits for vehicle write-off claims. Don’t keep waiting – the clock is ticking on your right to claim.

The UK Financial Ombudsman explains: “There are certain time-limit rules that apply to our service. One is when a complaint is referred more than six years after the event, or if later, three years after the consumer knew they had cause to complain.”[3]

If your car was subject to a total loss insurance claim within the last 6 years, you may still be able to recover your missing money.

How Allegiant Recovers Your Lost Money

We investigate whether you were underpaid on your car insurance total loss settlement. Our team doesn’t just respond to your enquiry – we take action:

- Analyse your original payout against market valuation tools

- Compare similar vehicles to identify potential underpayments

- Prove the correct value using comprehensive evidence

- Negotiate with your insurer to recover what you’re owed

- Fight for every pound you should have received

Some insurance companies only offer additional compensation when challenged. Without speaking up, you’ll never recover the money you lost.

Additional Considerations for Vehicle Owners

In addition to starting your claim with Allegiant, consider the following:

Insurance Premiums and Future Cover after an accident

After total loss claims, your insurance premiums may be affected when you purchase a new car. Insurers decide premiums based on various factors, including claim history.

Roadside Assistance and Total Loss

If your vehicle suffered an accident requiring roadside assistance, this may be the first indication that your car could be declared a write-off. Emergency services can assess whether damage makes economical repair unlikely.

Part Exchange and Motor Trade Section

Previously written-off vehicles that are restored to roadworthy condition may have reduced part exchange value. The motor trade section of the logbook becomes important when selling or scrapping such vehicles.

What Matters Most

No matter the category of damage, the key matter is ensuring you receive fair compensation. Don’t let cost concerns, time and stress prevent you from challenging an unfair insurance payout.

Don’t let your insurance company keep money that belongs to you.

Reclaim Your Money Now

References:

- [1] Examples of underpayments include £6,191 compensation awarded in Financial Ombudsman case DRN-4660949 and £899 in case DRN-3016070

- [2] FCA Press Release on Insurance Valuations

- [3] Financial Ombudsman Time Limits

Questions about our Vehicle write-off Claims Service…

Click below to see answers to common queries.

What does it mean when my car is written off?

A vehicle write-off, or total loss, occurs when your insurer decides that the cost of repairing your vehicle is economical based on its market value before the incident. The insurer will declare it a total loss and provide a settlement based on its pre-accident value.

Can I make a Reclaim if the car accident was my fault?

Yes you can still make a claim. An insurance company treats a claim as a “fault” claim when it can’t get back any of the costs it’s paid out to settle the claim from a third party (such as another driver’s insurer). This does not change the fact that your insurer should make a payout reflecting the true pre-accident market value of your vehicle.

Why do insurance companies sometimes undervalue vehicles?

Some insurers offer a lower initial settlement, assuming the customer might accept it or might not know how to challenge it. This is a point of concern highlighted by the UK regulator, the Financial Conduct Authority.

Even if the insurer increases its valuation, it still may not be high enough when compared to the objective guidance available for valuing vehicles.

I can’t remember the registration of my vehicle?

If you cannot remember the registration of your vehicle, we can still help. Simply enter the details of the vehicle manually and we should be able to find the vehicle and registration for you to continue a write-off claim.

What if I still have finance on a written-off vehicle?

You’re still responsible for any remaining finance payments. The reclaim against your insurer, for potentially undervaluing your written-off vehicle, is completely separate to any contractual agreement you have with your finance company.

Can I make a claim if I was a named driver on the policy?

Unfortunately, in order to make the claim, it would need to be the policyholder of the vehicle and not a named driver. Even if you were driving at the time of the accident. It would still need to be the policyholder who makes the claim

Is the write-off valuation affected by my car’s age or mileage?

Yes, the valuation considers factors like age, mileage, model, and additional features. Allegiant ensures these factors are considered fairly, where that information is available.

How far back can Allegiant go with write-off claims?

Allegiant can assist with claims for incidents up to six years old, making it possible to revisit past claims where recent guidance suggests a higher valuation should have been used. If the write-off is more than 6 years ago, certain time limit restrictions for making a reclaim could apply.

Our Vehicle Write-off Claims Process

We realise that claiming against an insurer may feel daunting. We aim to make the claiming process as simple as possible. Our experienced team will communicate with your insurance company (and where required, the Ombudsman service) on your behalf. We use bespoke technology to ensure efficient claims handling. Throughout the process, we inform you of claim progress using a “stage process”, so you can track your progress easily. Please remember, that you do not need to use a claims management company to make your complaint to your insurer, and if your complaint is not successful you can refer it to the Financial Ombudsman Service yourself for free.

Step 1

Pre complaint investigation and analysis

Step 2

Formal complaint made, where appropriate.

Step 3

Insurer responds with a Final Response Letter

Step 4

If an appropriate outcome cannot be reached, referral to Financial Ombudsman Service.

Our Fees - What You Need To Know

Our success fee is due only if your insurer makes a compensation payout, and is calculated on the amount of the compensation payout

The success fee amount is calculated using a band charging system. There are five charging bands. Each band has a maximum amount that we will charge.

Success Fee Charging Table

| Band | Compensation Payout | Percentage rate the Success Fee is calculated on (including VAT) | Maximum Success Fee in band (including VAT) |

| 1 | £1 to £1,499 | 36% | £504 |

| 2 | £1,500 to £9,999 | 33.60% | £3,000 |

| 3 | £10,000 to £24,999 | 30% | £6,000 |

| 4 | £25,000 to £49,999 | 24% | £,9000 |

| 5 | £50,000 or more | 18% | £12,000 |

Below are examples of how this would work in practice.

| Band | Comp Payout (Lower) | Success Fee (Lower) | Comp Payout (Higher) | Success Fee (Higher) |

|---|---|---|---|---|

| 1 | £100 | £36 | £1,499 | £504 |

| 2 | £1,600 | £537.60 | £9,999 | £3,000 |

| 3 | £12,000 | £3,600 | £24,999 | £6,000 |

| 4 | £30,350 | £7,284 | £49,999 | £9,000 |

| 5 | £55,000 | £9,900 | £100,000 | £12,000 |

If you want to see how much we would charge for a specific amount, please visit our online fee calculator on our fees page.

Please note that the examples in the tables are for illustration purposes only. They are not an estimate of the likely outcome or success fee.

Cancellation Rights

You can cancel for free at any time within 14-days without giving any reason and without incurring any liability. You can communicate your cancellation by telephone, post, email or online.

You can cancel this agreement at any time after the 14-day cancellation period. However, if a complaint submitted by us is successful, the Success Fee will apply in the usual way.

You can cancel by post: Allegiant Finance Services Limited, Freepost RTYU–XUTZ–YKJC, 400 Chadwick House, Warrington Road, Birchwood Park, Warrington, WA3 6AE; (b) by email: helpdesk@allegiant-finance.co.uk; (c) by telephone: 0345 544 1563; or (d) online at HERE.

A Claims Management Company You Can Trust.

A Safe Choice For Car Write-Off Claims.

A trusted name

Allegiant Finance Services was founded in 2010 and has helped over 100,000 customers reclaim over £80,000 across all claim types.

Friendly and understanding advisors

Vehicle write-offs can be traumatic. We’re here to support clients through their quest for reimbursement.

Confidential & Discreet

We will only correspond with you and keep your details secure. We’ll never sell your data

Online Application System

Fill in our form and our advisors will review whether you are eligible for our service.