MotoNovo Finance Claims: What You Need to Know

MotoNovo Finance claims relate to PCP hidden commission concerns and unaffordable lending.

Contents

- Introduction

- Background of MotoNovo Finance

- MotoNovo Finance Products

- FCA Review of Discretionary Commission

- Unaffordable Lending Claims

- Discretionary Commission Claims

- The Claims Process

- Conclusion

Introduction

MotoNovo car finance claims are on the increase. Motonovo has been a big name in car finance for over 40 years. Recently, there’s been a lot of talk about MotoNovo finance claims. This is because the Financial Conduct Authority (FCA) announced a review of how car finance companies have been doing business. If you’ve got a car loan from MotoNovo, you might be wondering what this means for you.

Let’s break down what’s happening and what you need to know about a MotoNovo finance claim.

Key Points: MotoNovo Finance Claims

- FCA announced review of discretionary commission arrangements on 11 January 2024

- MotoNovo Finance offers Hire Purchase (HP) and Personal Contract Purchase (PCP) options

- Potential for unaffordable lending and discretionary commission claims

- Customers may be entitled to compensation for mis-sold finance agreements

- Claims can be made through authorized claims management companies

Background to MotoNovo Finance

MotoNovo Finance is a company that helps people with the financing of cars, vans, and bikes by lending them money. They’re based in Cardiff, Wales, and have been around since the 1970s. Over the years, they’ve grown to be one of the biggest car finance companies in the UK. They know a lot about what customers need and what’s happening in the car finance world.

MotoNovo works with car dealers to offer finance options to customers. They’ve won awards for their service and have good reviews from many customers. In fact, they have a 4.6-star rating on Trustpilot from over 30,500 reviews. This shows that a lot of people like their service.

Unaffordable lending claims have become a big topic in the finance world, and MotoNovo is part of this discussion. These claims are about whether finance companies lent money to people who couldn’t really afford it. This has become a big deal recently, with regulators taking a closer look at how finance companies lend money.

MotoNovo Finance Products

MotoNovo offers two main types of finance:

- Hire Purchase (HP): This is where you pay for the car in monthly installments. Once you’ve made all the payments, the car is yours. You usually pay for 1 to 5 years. This is good if you want to own the car at the end.

- Personal Contract Purchase (PCP): With this option, you pay less each month, but at the end, you have to make a bigger payment to keep the car. Or, you can give it back or trade it in for a new one. This is good if you like to change cars often.

They also have a service called MotoNovo Commercial for businesses that need to finance vehicles. This is for companies that need cars or vans for their work.

Our services can help you understand which type of finance you have and if you might have a claim. We can explain things in a way that’s easy to understand.

FCA Review of Discretionary Commission

On January 11, 2024, the FCA said they’re going to look into how car finance companies have been using something called “discretionary commission arrangements.” This is important because it could mean that a lot of people paid more for their car finance than they should have. The FCA wants to make sure people are treated fairly when they borrow money.

The FCA stopped these arrangements in 2021, but they’re now looking at what happened before that. They think this might have cost customers about £165 million extra each year. This could mean that many people might be able to get some money back.

Unaffordable Lending Claims

Unaffordable lending is when a finance company gives someone a loan they can’t really afford to pay back. If this happened to you with MotoNovo, you might be able to make a claim. This is a serious issue because it can cause people a lot of money problems.

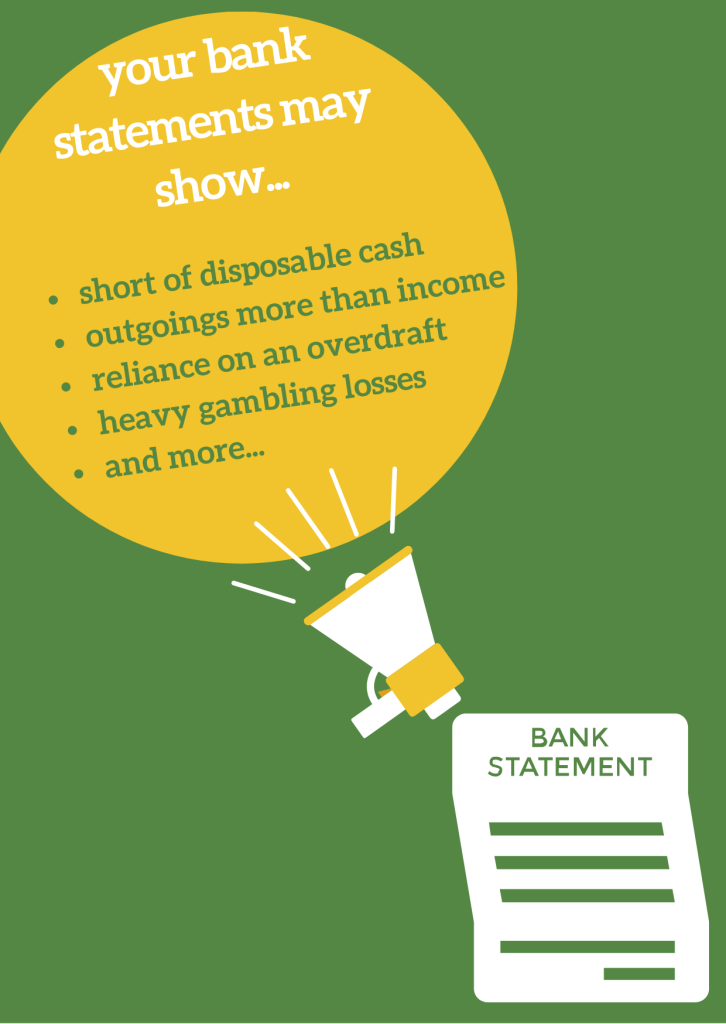

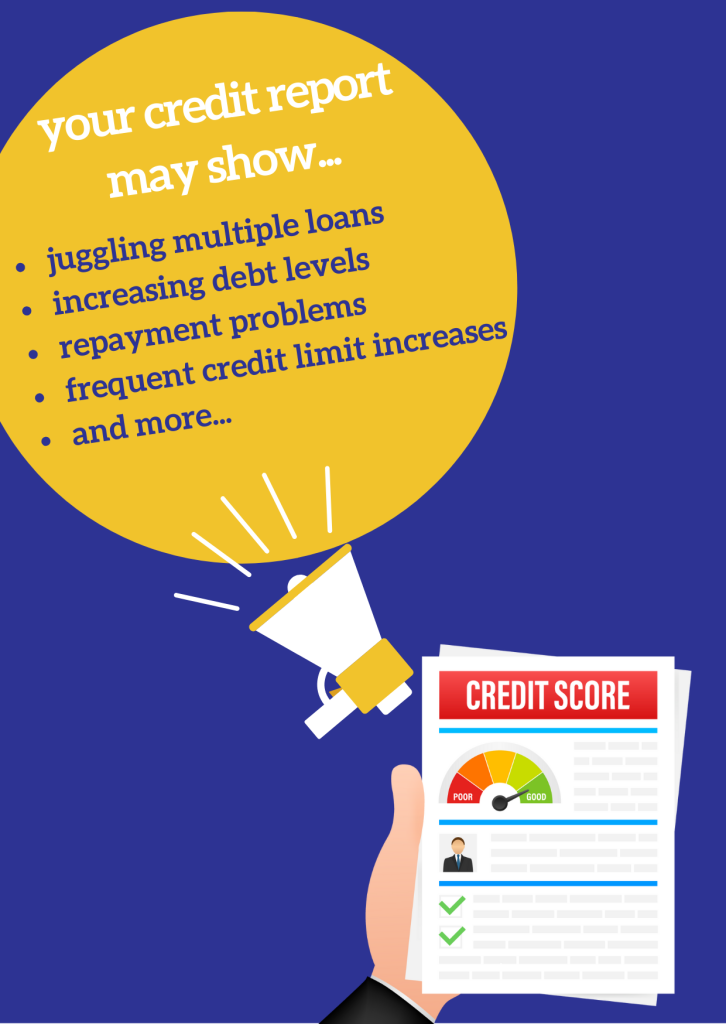

Signs that your loan might have been unaffordable include:

- You had to borrow more money to make your payments

- You fell behind on other bills to pay for your car

- You had to cut back on essentials like food or heating to make payments

- Your credit score got much worse after taking out the loan

- You couldn’t save any money because of the loan payments

Learn more about unaffordable lending claims and how we can help you check if you’re eligible. We can look at your situation and help you understand if you can make a claim.

Discretionary Commission Claims (PCP Claims)

Discretionary commission was a way that car dealers could set the interest rate on your finance. The higher the interest rate, the more money they got. This meant that some people ended up paying more than they needed to. It wasn’t fair because the dealers might have charged higher rates just to make more money.

The FCA found that on a typical £10,000 car finance agreement, customers paid around £1,100 more in interest than they should have. That’s a lot of extra money! This shows how much these arrangements cost people.

If you got car finance from MotoNovo before January 2021, you might be able to claim some of this money back. This is important because before 2021, these arrangements were allowed, but now they’re not.

The Claims Process

Making a claim might sound hard, but it doesn’t have to be. Here’s how it usually works:

- Gather your evidence: This includes your finance agreement and any other important papers. You might also need bank statements, credit reports, and letters from MotoNovo.

- Submit a complaint: You can do this directly yourself for free to MotoNovo or through a claims management company like us (fees apply). The complaint should explain why you think you were treated unfairly.

- Wait for a response: MotoNovo should respond within 8 weeks. They’ll look at your claim and the evidence you provided.

- If you’re not happy with the response, you can take your claim to the Financial Ombudsman Service. They’re independent and can make a final decision on your case.

Conclusion

MotoNovo finance claims are a big deal right now. If you’ve had car finance with MotoNovo, especially before 2021, you might be owed money. It’s worth checking if you could make a claim for unaffordable lending or unfair discretionary commission. You could get back a significant amount of money, and many people might not know they were affected.

Remember, you don’t have to do this alone. We can help you through the process, making it easier and less stressful. Our team knows a lot about these claims and can give you the best chance of getting your money back. We keep up with all the latest changes and have helped many people successfully make claims.

Don’t let the idea of making a claim put you off. It’s your right to be treated fairly, and if you’ve paid too much, you deserve to get that money back. Take the first step today and see if you could be owed compensation from MotoNovo Finance. The claims process is designed to be accessible to everyone, and getting professional help can really increase your chances of success.

Interested in using us to handle your claim? Get in touch with us today. Our friendly team is ready to look at your case and help you through every step of making a claim.

Our Unaffordable Lending Claims Process

We realise that claiming against your lender can seem daunting. We aim to make the claiming process as simple as possible. We specialise in affordability claims. Our experienced team will communicate with the lender (and where required, the Ombudsman service) on your behalf. We use bespoke technology to ensure efficient claims handling. Throughout the process, we inform you of claim progress using a “stage process”, so you can track your progress easily. Please remember though, that you do not need to use a claims management company to make your complaint to your lender, and if your complaint is not successful you can refer it to the Financial Ombudsman Service yourself for free.

Step 1

Pre complaint investigation and analysis

Step 2

Formal unaffordable lending complaint made

Step 3

Lender responds with a Final Response Letter

Step 4

If appropriate resolution cannot be reached with the lender, referral to Financial Ombudsman Service.

Our Fees

Our success fee is due only if your bank makes a compensation payout, and is calculated on the amount of the compensation payout

The success fee amount is calculated using a band charging system. There are five charging bands. Each band has a maximum amount that we will charge.

Success Fee Charging Table

| Band | Compensation Payout | Percentage rate the Success Fee is calculated on (including VAT) | Maximum Success Fee in band (including VAT) |

| 1 | £1 to £1,499 | 36% | £504 |

| 2 | £1,500 to £9,999 | 33.60% | £3,000 |

| 3 | £10,000 to £24,999 | 30% | £6,000 |

| 4 | £25,000 to £49,999 | 24% | £,9000 |

| 5 | £50,000 or more | 18% | £12,000 |

Below are examples of how this would work in practice.

| Band | Comp Payout (Lower) | Success Fee (Lower) | Comp Payout (Higher) | Success Fee (Higher) |

|---|---|---|---|---|

| 1 | £100 | £36 | £1,499 | £504 |

| 2 | £1,600 | £537.60 | £9,999 | £3,000 |

| 3 | £12,000 | £3,600 | £24,999 | £6,000 |

| 4 | £30,350 | £7,284 | £49,999 | £9,000 |

| 5 | £55,000 | £9,900 | £100,000 | £12,000 |

If you want to see how much we would charge for a specific amount, please visit our online fee calculator at https://allegiant.co.uk/unaffordable-lending-claim-fees.

Please note that the examples in the tables are for illustration purposes only. They are not an estimate of the likely outcome or success fee.

Cancellation

You can cancel for free at any time within 14-days without giving any reason and without incurring any liability. You can communicate your cancellation by telephone, post, email or online.

You can cancel this agreement at any time after the 14-day cancellation period. However, if a complaint submitted by us is successful, the Success Fee will apply in the usual way.

You can cancel by post: Allegiant Finance Services Limited, Freepost RTYU–XUTZ–YKJC, 400 Chadwick House, Warrington Road, Birchwood Park, Warrington, WA3 6AE; (b) by email: helpdesk@allegiant-finance.co.uk; (c) by telephone: 0345 544 1563; or (d) online at https://allegiant.co.uk/compliance/cancellation.

Genuine Customer Reviews

The Smart Choice For Unaffordable Lending Claim Representation

A trusted name

Allegiant Finance Services is widely regarded as a pioneer in the high cost loan claims management market.

Friendly and experienced advisors

Contactable by email, phone, or post, whichever you prefer

Confidential & Discreet

We will only correspond with you and keep your details secure. We’ll never sell your data.

True Online Application System

Much more than a contact form. With our full online application process you will receive an instant automated decision on whether we can take on your claim

£108 million in compensation - £87 million in cash, £21 million in debt deductions, since 2013

Successfully recovered across unaffordable lending, Scam & Fraud, Car Finance Commission and vehicle write-off claims since 2013

Proven Track Record

We’ve been claiming high cost loan refunds since 2013