When people in the UK wish to try and regain the money they’ve lost through mis-selling or mistreatment by a financial firm (such as a bank or insurance company), they can claim themselves for free. However, some people choose to use a claims management company (CMC) to help them claim. Allegiant Finance is one of these UK-based CMCs.

Why people choose to use a CMC:

The number one reason Allegiant Finance customers give for choosing Allegiant is stress reduction of the claims process.

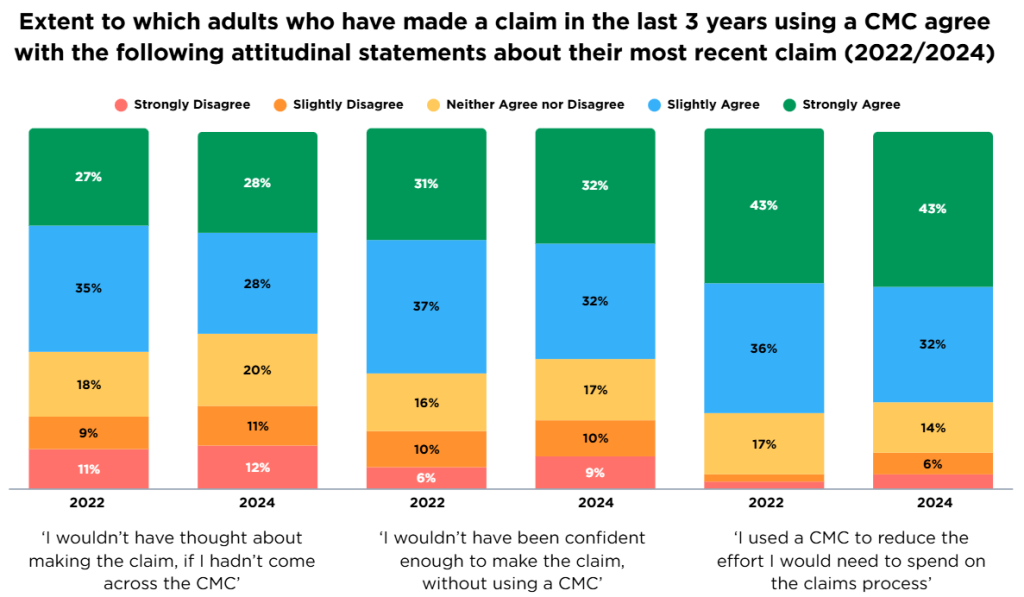

We also know the following from research provided by the Financial Conduct Authority:

“In 2024, 57% of CMC users said they would not have thought about claiming, and 64% would not have been confident enough to make the claim, without a CMC. 76% used a CMC to reduce their effort on the claims process.”[1]

Source: Financial Conduct Authority (2025), Financial Lives 2024 survey: Claims management – Selected findings, p. 38. Recreated by Allegiant from published percentages (excludes “don’t know” responses). No FCA endorsement implied.

Having an expert professional on your side:

Some people use a claims management company because they want help from someone who is experienced in making similar claims.

Allegiant has been helping customers with irresponsible lending claims since 2013. One of our customers was Mr G. We helped Mr G with his irresponsible lending claim against Tesco and took his case to the Financial Ombudsman Service (FOS) for him. Initially, the FOS Investigator did not agree that there had been irresponsible lending. But our claims handlers at Allegiant escalated Mr G’s claim to an Ombudsman. We pointed out that Mr G’s indebtedness had increased to levels where it was no longer appropriate for Tesco to lend to him. The Ombudsman took on board what we said – as Mr G’s professional representatives – and this resulted in the Ombudsman overturning the Investigator’s findings, and awarding compensation to Mr G:

“Last year, representatives acting on Mr G’s behalf complained that Tesco Bank lent irresponsibly and it issued a final response.”

“Mr G’s representatives asked to appeal and said Mr G’s unsecured debt levels had increased substantially during the period between the application and credit limit increase.”

“I’ve reached a different decision in relation to the credit limit increase. As Mr G’s representatives have pointed, his circumstances appear to have changed by the time his credit limit was increase to £8,300 in January 2024.”

“Mr G’s representatives have forwarded open banking data for his current account covering the months before the credit limit increase and I’ve gone on to review it.”

“I haven’t been persuaded that Tesco Bank lent responsibly when it increased Mr G’s credit limit to £8,300 in January 2024 so I intend to uphold his complaint and direct it to refund all interest, fees and charges applied from that date to balances over £6,300.”[2]

Beware of scams:

The Financial Conduct Authority (FCA) has reported:

“Scammers are pretending to be car finance lenders and falsely claiming that people are owed compensation.”[3]

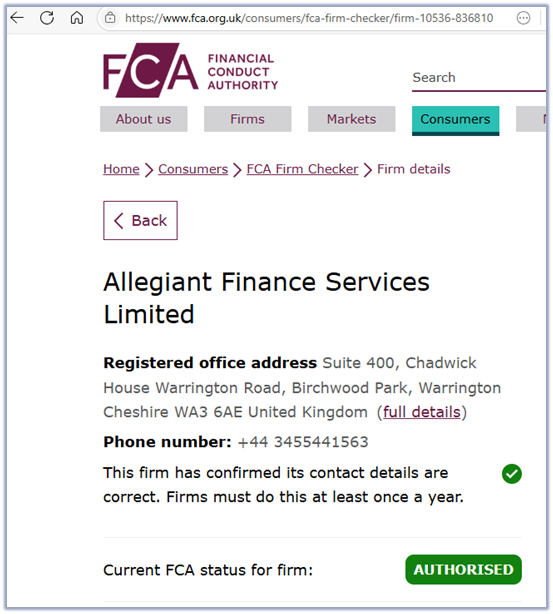

Remember that all genuine claims management companies (including Allegiant Finance) and genuine car finance lenders will be on the FCA’s Financial Services Register: https://register.fca.org.uk/s/

If you have any doubts at all about someone phoning you out of the blue, you can always get in touch with that company using the contact details provided by the Financial Services register – because you know that they will be genuine.

[1] Financial Lives 2024 survey – Claims management: Selected findings