The UK’s Most Written-Off Cars – Could You Have Been Underpaid in the Last 6 Years?

In the last 6 years, millions of cars were written off by UK insurers. In fact, a freedom of information request we recently made showed that over 3 million cars were written off between 2019 and 2024, with an increasing trend since COVID. Many of those drivers may not have received the fair payout they were entitled to.

This blog looks at which cars have been most commonly written off, why that matters for consumers, and how Allegiant can help if you think your insurer undervalued your settlement.

The most written-off cars in Britain

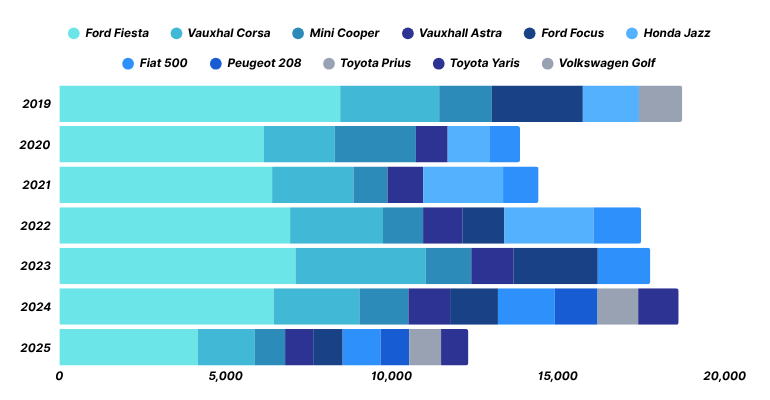

Using Freedom of Information data from the DVLA, we’ve identified the vehicles most frequently declared total losses between 2019 and 2025. These figures combine all years into a single national snapshot:

| Rank | Make & Model | Number of Write-Offs (6 Years) |

|---|---|---|

| 1 | Ford Fiesta | 71,895 |

| 2 | Vauxhall Corsa | 25,880 |

| 3 | Fiat 500 | 19,839 |

| 4 | Mini Cooper | 15,388 |

| 5 | Ford Focus | 7,243 |

| 6 | Vauxhall Astra | 6,938 |

| 7 | Honda Jazz | 5,036 |

| 8 | Peugeot 208 | 2,179 |

| 9 | Toyota Prius | 2,178 |

| 10 | Toyota Yaris | 2,062 |

| 11 | Volkswagen Golf | 1,303 |

| Total | 163,182 vehicles |

(Source: Allegiant analysis of DVLA FOIR12767 data, 2019–2025)

What the most written-off cars data tells us

This data shows that small, popular cars dominate the list. The Ford Fiesta, Vauxhall Corsa, and Fiat 500 alone make up more than half of all the top recorded car write-offs.

These are not high-end vehicles — they’re the everyday cars most of us drive. That’s why it matters: when valuation errors occur, they don’t just affect rare cases; they impact millions of ordinary people.

At Allegiant, we’ve seen that many drivers were paid less than their car’s true market value when their vehicle was written off, sometimes without even realising it.

Why payouts may have been too low

The Financial Conduct Authority (FCA) and Financial Ombudsman Service (FOS) have raised concerns about write-off valuations.

In some cases, insurers used outdated trade data, overlooked trim levels or extras, or failed to reflect real-world market prices.

“When making an insurance claim, people shouldn’t need to question whether they are being offered the right amount for their written-off car or other goods that they need to replace. Insurance firms should offer settlements at the fair market value. This is especially important now as people struggling with the cost of living will be hit in the pocket at precisely the time they can ill afford it.” – Financial Ombudsman Service guidance

Even small discrepancies can make a big difference to your payout — especially on models like the Fiesta or Corsa, where there’s a wide range of trims and resale values.

The FCA conducted a multifirm review, their expectations were clear on what they expect insurers to do.

Firms must handle claims promptly and fairly, in line with their obligations under ICOBS 8.1. In this context, we would expect firms’ processes for valuing vehicles to identify a fair estimate of their market value.

Since this review, motorists have been paid out an estimated £129 million in compensation. This illustrates the scope of the issue and why you should reconsider whether your offer was fair.

How Allegiant helps consumers check for underpayments

If your car was written off in the last six years, Allegiant can help review your original settlement to see whether you may have been underpaid.

Our experienced financial claims team will:

Analyse your insurer’s valuation compared to historical market data

Review evidence of your car’s mileage, spec, and condition

Identify where valuations may not have reflected FCA guidelines and FOS guidelines

Handle the process for you — from investigation to communication with the insurer

We work on your behalf to ensure you weren’t left short-changed, using the same regulatory and data standards that underpin the industry.

Do you need to do this yourself?

You can always raise a complaint directly with your insurer or the Financial Ombudsman Service yourself, completely Free. The process often requires detailed valuation evidence and knowledge of regulatory precedents; however, it is entirely possible to do it independently, and many people do so.

By working with Allegiant, you’ll have a team that specialises in mis-valued car write-off claims, with access to historic valuation databases, FOS case outcomes, and FOI-backed evidence.

Our role is to make the process clear, fair, and fully managed — not pushy, not urgent, but supportive.

Insurers we’ve helped customers claim against

Key takeaway

Over 3 million vehicles have been written off in the last six years.

Many payouts were below fair market value, and some of the most written-off car models, like the Ford Fiesta, Vauxhall Corsa, and Fiat 500 could be eligible

Allegiant’s expert team can review your past settlement and identify if you could be owed more.

Understanding your rights is the first step — Allegiant is here to help you take the next one, with clarity and care.